New YorkCNN

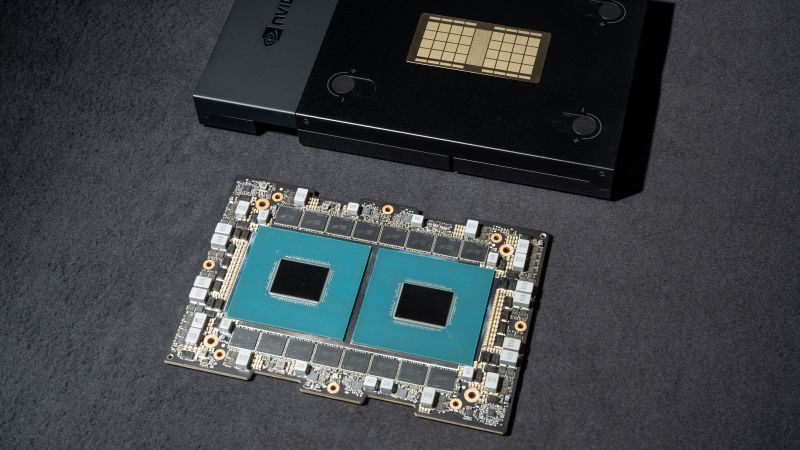

The past year was a momentous period for artificial intelligence, and chipmaker Nvidia emerged as a significant beneficiary of this trend.

Nvidia’s latest earnings report, unveiled on Wednesday, disclosed a notable rise in profits to nearly $12.3 billion for the quarter ending on January 28. This represented an impressive 769% surge from the corresponding quarter the prior year, exceeding even the optimistic forecasts of Wall Street analysts. The company’s annual profits also demonstrated remarkable growth, increasing by over 580% from the previous year.

Apart from the substantial profit surge, Nvidia saw a 265% boost in fourth-quarter revenue compared to the prior year, surpassing analyst predictions. This growth was fueled by the sustained momentum in AI investments.

CEO Jensen Huang underscored the global upsurge in demand across diverse companies, industries, and nations, underscoring Nvidia’s pivotal role in the expanding AI domain.

Nvidia commands a dominant position in the AI semiconductor market, representing about 70% of sales in this sector. Despite facing competition from tech behemoths such as Meta, Amazon, IBM, and Microsoft, who are venturing into developing their own chips, Nvidia remains unparalleled in manufacturing processors for AI systems, including generative AI technology utilized for text and image creation.

The company’s fundamental data center business experienced an extraordinary 409% year-over-year growth in the fourth quarter, achieving a record $18.4 billion. This surge was driven by strategic collaborations with major infrastructure entities like Google, Amazon, and Cisco.

While Nvidia’s stock price soared by roughly 230% in 2023, positioning it as a standout performer in the market, some investors harbor concerns regarding the sustainability of such rapid expansion. The imposition of US restrictions on the export of advanced AI chips to China, affecting Nvidia’s H800 and A800 chips, poses a potential threat to the company’s access to a critical and expanding market.

Despite these hurdles, Nvidia remains upbeat about its future trajectory. The company’s outlook remains optimistic, with robust demand for its AI chips outstripping current supply levels. Nvidia foresees a revenue estimate of approximately $24 billion for the upcoming quarter, indicating a significant 233% surge from the same period last year, surpassing market anticipations.