Dan Niles, a seasoned portfolio manager at Satori Fund, evaluates the performance of the “Magnificent 7” stocks and delves into the upcoming investment opportunities in ‘Making Money.’

Nvidia’s CEO, Jensen Huang, envisions the advent of artificial general intelligence (AGI) within a mere five years as a default projection.

During his appearance at a financial forum hosted by Stanford University, Huang, who spearheads the world’s leading producer of artificial intelligence chips utilized in constructing systems like OpenAI’s ChatGPT, responded to inquiries regarding the timeline for achieving AGI capabilities akin to human cognition. He emphasized that the timeline hinges significantly on how the AGI benchmark is defined. Huang posited that if the benchmark is centered on surpassing human-level tests, AGI could materialize imminently.

Huang expressed confidence in the potential of AI technology, stating, “If I provide an AI with every conceivable test and present this comprehensive checklist to the computer technology sector, I anticipate that we will excel across the board within five years.”

NVIDIA CEO’s Wealth Surges by $9.6 Billion Amid AI Chipmaker Stock Soaring

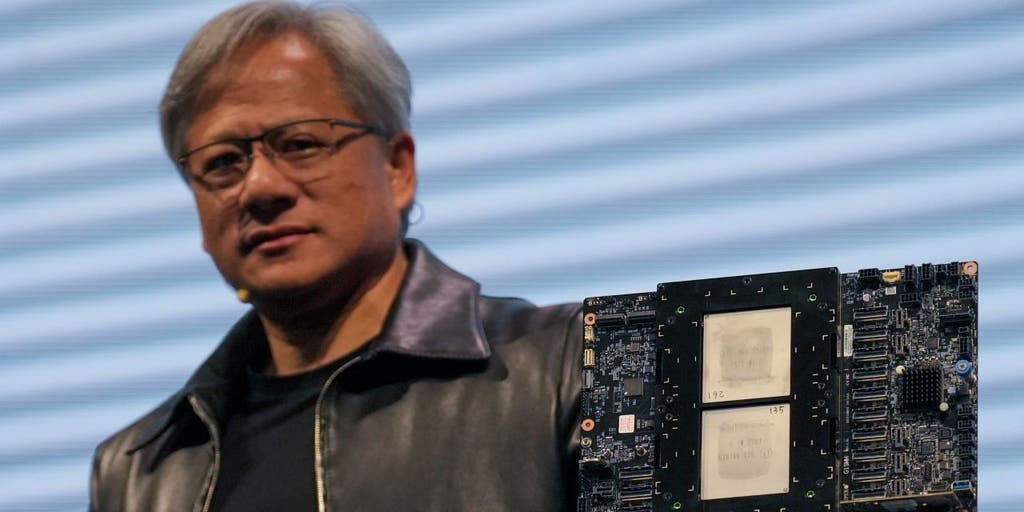

At the keynote presentation during COMPUTEX 2023, Jensen Huang, the President of NVIDIA, unveiled the groundbreaking Grace superchip CPU tailored for relational AI. The event, hosting over 1,000 exhibitors from 26 nations, spans from May 30 to June 2, as showcased in the photo by Walid Berrazeg/SOPA Images/LightRocket via Getty Images/Getty Images.

While AI has demonstrated proficiency in passing legal bar exams, it encounters challenges in specialized medical assessments such as gastroenterology.

Huang highlighted the divergence in defining AGI, suggesting that progress may vary as scientists grapple with elucidating the complexities of human cognition.

Establishing clear objectives is imperative for professionals, Huang emphasized, underscoring the formidable nature of achieving expertise in this domain.

NVIDIA’s Market Value Surges following a 265% Revenue Boost Driven by AI Expansion

Jensen Huang, the co-founder and CEO of Nvidia, underscores the significance of defining AGI parameters. (Photographer: I- Hwa Cheng/Bloomberg via Getty Images/ Getty Images)

Furthermore, Nvidia’s CEO deliberated on the necessity for additional semiconductor companies, or “fabs,” to support the burgeoning AI sector’s growth.

TickerSecurityLastChangeChange the percentageNVDANVIDIA CORP822.79+31.67+4.00%

Reports indicate that Sam Altman, the CEO of OpenAI, has been exploring funding opportunities for an AI hardware venture, suggesting a potential surge in demand for fabs.

Decoding Artificial Intelligence (AI): An Insightful Overview

Nvidia’s pivotal role as a premier AI chip innovator has propelled a substantial surge in its stock value. (Photo by Jakub Porzycki/NurPhoto via Getty Images) / Getty Images

Anticipating the escalating demand, Huang acknowledged the need for more fabs while highlighting the continuous enhancement in chip performance and algorithms, thereby mitigating the volume of chips required by end-users.

“We anticipate the expansion of fabs,” he affirmed. “However, the ongoing enhancements in AI processing and algorithms will significantly elevate technology performance over time.” Huang projected a monumental advancement of a millionfold in computer capabilities over the next decade.

Nvidia recently surpassed the $2 trillion milestone in market capitalization, outpacing tech giants like Google and Amazon to secure the third position among U.S. companies by market cap, trailing only Apple and Microsoft.

In 2024 alone, Nvidia’s stock has surged by 70%. The AI chip leader’s stock has skyrocketed by 2,084% over the past five years and by 244% in the last year.

Reuters contributed to this report.