A surge in energy demand, as indicated by producers, is poised to usher in a transformation in artificial intelligence and the fuel for data centers.

According to industry leaders, the escalating electricity requirements of AI will surpass the capabilities of solar energy and batteries, necessitating additional fossil fuel resources despite governmental commitments to decrease their utilization.

Toby Rice, deputy executive of EQT, the largest oil producer in the country, emphasized that the forthcoming expansion of AI will rely on oil. He highlighted that the technology sector is generating profits for shale producers similar to the growth experienced by the US liquefied natural gas industry, which has opened up new markets for drillers.

“Liquid LNG has established a truly remarkable emerging market. However, there is another emerging market that is garnering significant interest—energy demand,” Rice stated.

In an effort to rapidly reduce carbon emissions from the power grid, the US government has presented extensive opportunities to developers of clean energy. Nonetheless, fossil fuel experts argue that renewable energy alone cannot meet the demands of energy-intensive data centers.

Energy Capital Partners, a major private investment firm with both green and fossil fuel energy assets, asserts that the expansion of gas-fired technology will be vital in complementing alternative energy sources for data centers.

Doug Kimmelman, founder and senior partner at ECP, stated that gas is the sole energy option capable of delivering the consistent power required by major technology firms to drive the AI surge.

Colin Gruending, a senior executive at Enbridge, expressed optimism about the increased use of gas. He remarked that “intermittent renewables will not suffice,” echoing the sentiments of other industry insiders.

The optimistic outlook of US coal and gas producers is fueled by a decline in natural gas prices, prompting oil producers to consolidate and explore new avenues for growth.

This perspective contrasts with the commitments of major tech companies to reduce greenhouse gas emissions and advance the AI revolution using alternative energy sources rather than fossil fuels. Environmental experts caution that expanding the fossil fuel infrastructure could undermine global efforts to combat climate change.

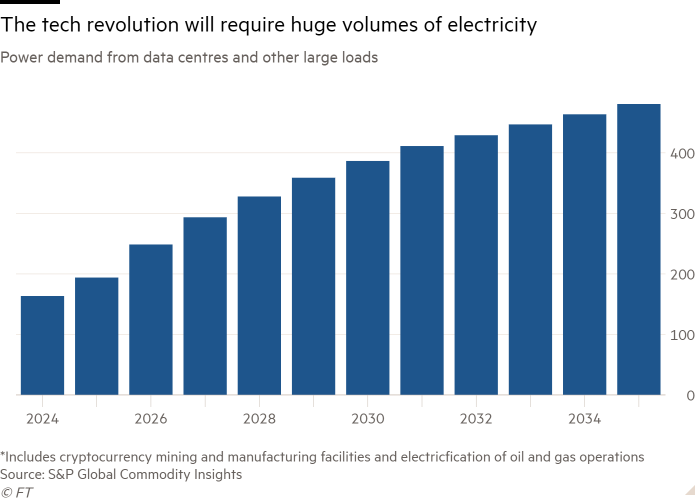

However, the power-intensive demands of data centers are projected to skyrocket, driven by cloud storage services, cryptocurrency mining, and AI applications, straining the power grid. By 2035, these energy-intensive operations collectively are estimated to consume over 480 terawatt-hours of electricity, equivalent to approximately one-tenth of the total US power demand, up from 4.5 percent in 2025.

Dominion Energy, a key provider for Virginia’s rapidly expanding data center sector, emphasized in a recent strategic plan that until zero-carbon energy sources can offer continuous power, gas facilities remain the “most cost-effective and reliable” choice.

More than 40% of US power generation is attributed to gas-fired facilities, significantly higher than other energy sources, with the abundance of shale resources driving down the cost of coal production over the past decade. Federal projections indicate the construction of 20 new gas-fired power plants by 2024 and 2025 to meet the escalating demand.

Producers’ strategies to capitalize on the energy demands of Big Tech align with the ambitious objectives of companies like Google and Microsoft, aiming to power their operations solely with certified green energy in the near future.

Analysts suggest that if these goals are achieved, it could challenge the optimistic projections of fossil fuel producers regarding gas consumption.

Xizhou Zhou, S&P’s head of power and renewables, anticipates that climate-friendly energy sources will drive the majority of new demand growth. The group predicts that by the end of the decade, gas-fired power generation will plateau while green energy generation will surge.

Peter Herweck, the head of Schneider Electric’s energy management division, raised doubts about the extent to which gas will benefit compared to what fossil fuel proponents claim.

While the oil industry asserts that fossil fuels are the only solution to meet the rising energy demand, many data center clients have committed to using renewable energy sources, insisting on renewable power.

The rapid pace of this revolution introduces uncertainty into forecasts, with industry experts noting a delay in the anticipated decline in gas usage. Rich Voorberg, president of Siemens Energy North America, a leading energy technology group, remarked, “We anticipated a decrease in gas consumption in the coming years. However, that decline seems to be further postponed.”