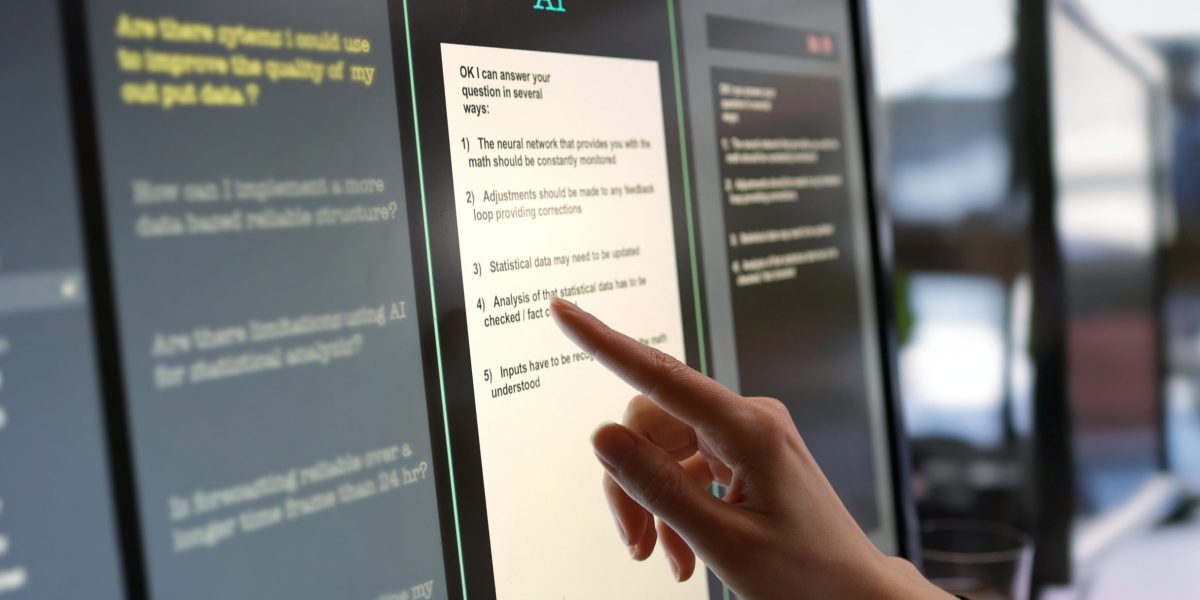

Greetings, evening. We are embarking on what a respected tech analyst has termed “The Year of AI,” which holds significant implications for major corporations. Dan Ives, from Wedbush Securities, expressed in a recent communication to investors that artificial intelligence is positioned as a key player in Wall Street’s burgeoning tech bull market, which is already underway.

In his analysis based on our latest research endeavors in the field, Ives emphasized that “the expanding use cases for AI globally remain pivotal for tech firms and overall industry advancement.” I had a discussion with him regarding the research conducted by Wedbush and GBK Collective, involving a survey of 672 companies, to delve deeper into the subject.

“Numerous entities are looking to integrate conceptual AI by 2024.” This emerges as a top priority within IT budgets, shared Ives, projecting that generative AI could represent 8% to 10% of this year’s budget and less than 1% in 2023.

What caught his attention was the accelerated pace of adoption in advertising, which he believes is ahead of market expectations.

Ives posits that these use cases could “unlock a wealth of opportunities.” For example, more than 80% of the surveyed companies identified 10 or more use scenarios aimed at enhancing business operations, including tasks like data analysis, content generation, and document editing and summarization. The trend towards leveraging conceptual AI to establish a more cost-effective operational framework is becoming increasingly apparent, according to Ives.

CFOs have also shared insights with me on the anticipated impact of AI on finance in 2024. According to their assessments, it could enhance operational efficiency and pave the way for new avenues of strategic thinking. Matt Candy, a global managing partner in conceptual AI at IBM, envisions a future where work is not only more efficient but also more creative.

In an interview with Fortune, Candy predicted that individuals proficient in language and innovative thinking collaborating with AI will occupy key roles in the future workforce. He mentioned that they are essentially teaching AI to understand human language, rather than the reverse scenario of humans needing to grasp the intricacies of engineering and programming servers.

As per Wedbush’s interactions with industry players on conceptual AI, Microsoft is currently leading the charge in fostering an AI-centric culture among major tech firms, as per Ives. Nonetheless, Google is not far behind, with some CIOs viewing it as a potential major player in generative AI down the line. Ives anticipates that in the coming years, other tech giants such as Amazon, Meta, Nvidia, Apple, and various smaller market players will collectively invest billions in this Artificial arms race.

Leaderboard

Effective January 1, 2024, Kate Clune assumed the role of CFO at Piper Sandler Companies (NYSE: PIPR), an investment bank. Tim Carter, who will remain with the company until April to facilitate the transition, has been succeeded by Clune. Clune joins from Evercore Inc., where she most recently served as manager and head of planning and strategy. Her prior experience spans 16 years at Morgan Stanley, holding positions such as global head of financial planning and analysis, business banker, and CFO of their U.S. banks.

H World Group Limited (Nasdaq: HTHT), a hotel management entity, appointed Jun Zou as CFO effective January 2. Jihong He resigned as CFO to assume the role of the company’s chief strategy officer, succeeding Zou. Zou previously served as the executive vice president of the company, bringing over 30 years of experience to the position. Before joining H World, Zou held the CFO position at Shenzhen Qiqitong Technology Co., Ltd. and several other organizations, including Xunlei Limited and the global technology services division of Huawei Technologies Co., Ltd.

A significant development

Morgan Stanley’s E-Trade released data from its regular sector rotation review. The analysis is based on the buy/sell behavior of customers using the trading platform for shares in the S&P 500 sectors.

Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley, noted that clients continued to show reluctance towards traditionally defensive sectors, with healthcare maintaining its top position in the market standings for December. Larkin highlighted that clients perceived less potential in interest rate-sensitive sectors like real estate and financials, given the possible shift in the rate environment. Sectors like consumer discretionary, communication services, and information technology, which typically attract optimistic clients, experienced subdued selling during this period.

Additional Information

An expert shared insights in a recent Fortune article on three distinct types of breaks one should consider taking. Planning out the year’s PTO in January could aid in “mitigating the impact of burnout.”

Industry Buzz

“The teams currently spending the most money are not doing so due to internet discounts. They have essentially built real estate empires, a concept I find intriguing. Understanding the retail and sports industries has been challenging enough, let alone delving into real estate.”

During a press briefing, Mark Cuban, the entrepreneur, co-founder of Cost Plus Drugs, and a prominent figure on Shark Tank, discussed the sale of his majority ownership in the Dallas Mavericks NBA team to individuals associated with the late Las Vegas casino mogul Sheldon Adelson. The NBA approved the $3.5 billion deal, allowing Cuban to retain a minority stake. Cuban believes that real estate will be instrumental for NBA teams to succeed both on and off the court.