Ten days following the Super Bowl, Wall Street hosted its own version, as per some social media investors. Nvidia, renowned for dominating the market with a majority of cards amid the surge in artificial intelligence interest, was set to unveil its highly-anticipated weekly earnings, poised to impact the markets significantly.

The company’s performance exceeded expectations, showcasing a remarkable 265% surge in revenue compared to the previous year. Consequently, the S&P 500 witnessed a 2.5% upsurge the subsequent day, while the tech-centric Nasdaq experienced an almost 3% increase.

“This surge can be solely attributed to Nvidia’s robust earnings,” stated Steve Sosnick, the chief strategist at Interactive Brokers, underscoring the prowess of AI, as reported by ABC News.

Contemplating a scenario where Nvidia failed to deliver, Sosnick pondered on the potential ramifications. He highlighted the escalated risk if a specific cluster of companies was indeed propping up the market due to AI-related activities.

Since the year commenced, the stock market has witnessed substantial growth, largely propelled by key technology players riding the AI wave. Supporters view this trend as emblematic of a common focus at the onset of a technological revolution, channeling limited resources towards AI innovation and advancement.

However, critics caution that if AI fails to live up to the lofty promises advocated by enthusiasts, the practical applications of AI for profit may remain a distant vision. Some analysts cited by ABC News expressed concerns that individuals with investments in 401(k) plans and college funds could face financial losses due to fluctuations in the S&P 500.

Sosnick asserted that “AI has entered hyperdrive,” emphasizing the potential risks associated with the current market dynamics. Everyday investors rely on the S&P 500 for its perceived diversity across various companies, highlighting an underappreciated risk in the current landscape.

Recent months have seen a surge in investor confidence in major stock indexes, particularly fueled by the optimism surrounding AI technology. However, the gains have been predominantly steered by a select group of software giants, dubbed the “Beautiful 7,” comprising Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, and Nvidia.

Given the market value-based weightage system of the S&P 500, these behemoths wield significant influence, with the Beautiful 7 accounting for nearly two-thirds of the index’s 24% surge in 2023, according to a Reuters assessment.

Dan Ives, the managing director of equity research at Wedbush, noted that the AI trend has been a pivotal driver of the ongoing tech bull market and broader market trends. Notably, Microsoft, the world’s most valuable company, has witnessed a substantial 75% stock increase since the year commenced.

The uptrend for Microsoft commenced with the announcement of a $10 billion investment in OpenAI, the AI company behind ChatGPT, in January 2023. Subsequently, Microsoft’s Bing integrated ChatGPT as its default search engine, further solidifying its AI endeavors.

As per a Bloomberg report from October, Apple, the second-largest company globally, is strategically incorporating advanced AI across its product spectrum, while Nvidia ascended to the position of the third-largest company worldwide earlier this month.

At the DealBook conference hosted by The New York Times on November 29, 2023, in New York City, Jensen Huang, the Founder and CEO of NVIDIA, took center stage, as captured by Michael M. Santiago/Getty Images/FILE.

Analysts optimistic about the industry acknowledge the top-heavy concentration but anticipate broader gains as AI proliferates across various sectors, propelling smaller businesses into the limelight. Mike Loukas, the CEO of TrueMark Investments specializing in exchange-traded funds (ETFs), emphasized that “chatbots are just the tip of the iceberg,” underscoring the enduring impact of the AI revolution.

TrueMark Investments offers an ETF enabling investors to tap into a basket of around two hundred AI-focused companies, ranging from industry giants like Nvidia to lesser-known entities, witnessing a 52% surge over the past year.

“The initial phases often reflect investments in visible, comprehensible entities,” remarked Loukas, highlighting the current focus on prominent corporations driving revenue. He anticipates a broader market impact in the future.

Ives pointed out that the influx of AI investments is spurring corporate expenditures in the technology domain, potentially catalyzing wider market penetration and accelerated growth. He anticipates a ripple effect stemming from this substantial spending spree.

Despite the optimism, skeptics raise concerns about the lack of concrete evidence showcasing AI’s benefits beyond a handful of tech giants. They argue that the anticipated industry boom may falter without widespread adoption.

A recent study by a consortium of researchers from leading universities and national institutions revealed that less than 6% of companies have integrated AI-related technologies. However, a majority of large enterprises reported some level of AI utilization.

Kristina McElheran, a business professor at the University of Toronto and study co-author, highlighted the absence of a universally accepted definition of AI and the secrecy shrouding some companies’ AI initiatives. She cautioned against the exuberance surrounding AI potentially outpacing its actual implementation across businesses.

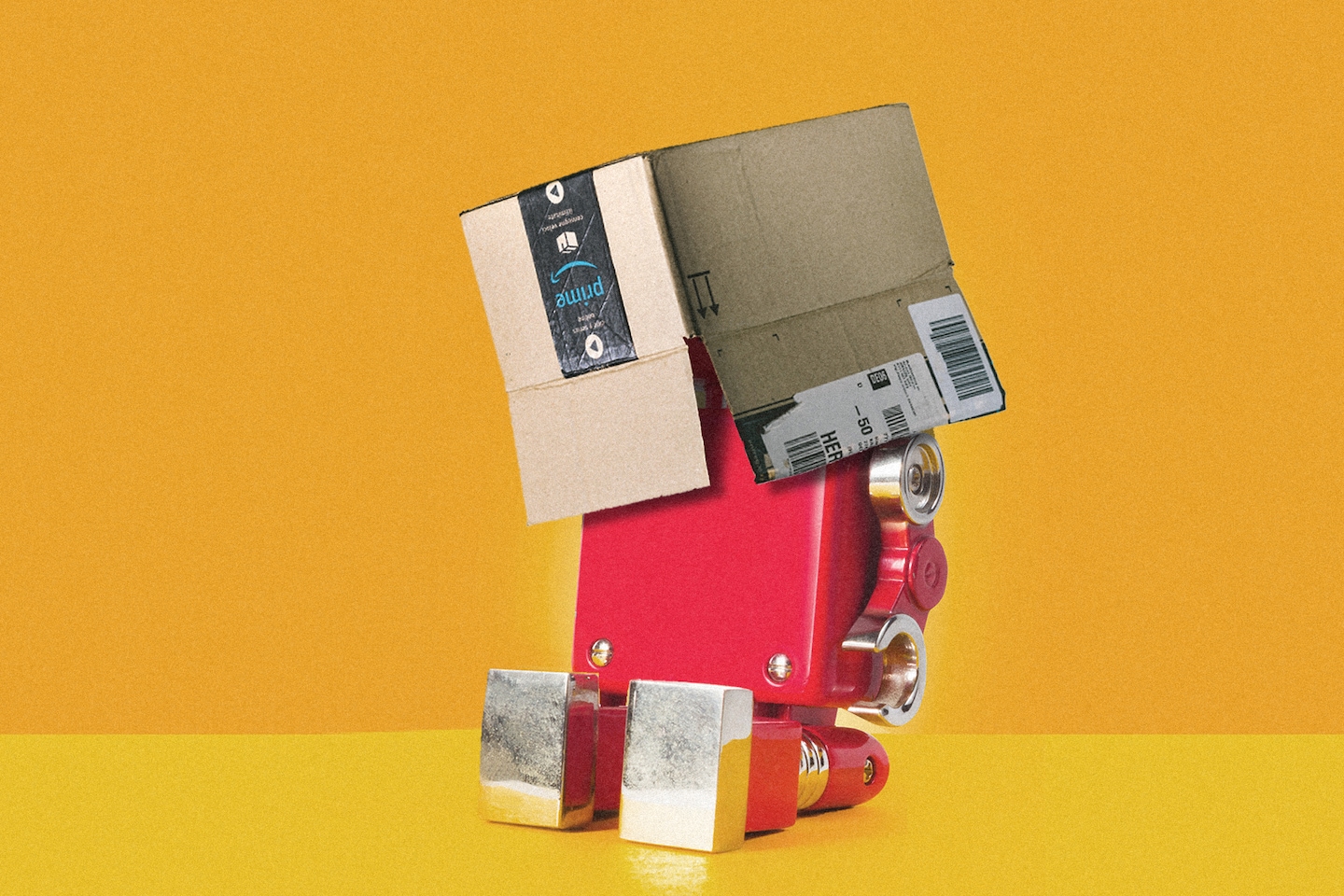

Sosnick from Interactive Brokers emphasized that for regular businesses, the tangible benefits of AI remain unclear. He likened Nvidia’s role to “selling the picks and shovels to the gold miners,” underscoring the pivotal aspect of AI’s impact on organizations’ bottom lines, which currently remains ambiguous.