Nvidia Corporation NVDA is set to announce its fiscal fourth-quarter earnings post-market on Wednesday, a highly anticipated event impacting both the chipmaker and the broader market. As a frontrunner in the realm of artificial intelligence (AI), Nvidia’s financial performance holds significant sway over investor sentiment.

Fourth Quarter Projections: Analysts across Wall Street are in unanimous agreement, forecasting a robust quarter with an average of \(4.64 non-GAAP EPS and \)20.62 billion in revenue, based on data from Benzinga Pro.

Comparative Analysis of Q4 Expectations with Historical Data:

ConsensusQ4’23Estimated Year-on-Year GrowthQ3’24Estimated Quarter-on-Quarter GrowthGuidanceRevenue\(20.62B\)6.05B+241%\(18.12B+13.8%\)20B+/- 2%Non-GAAP EPS\(4.6488 cents+427%\)4.02+15.4%N/A

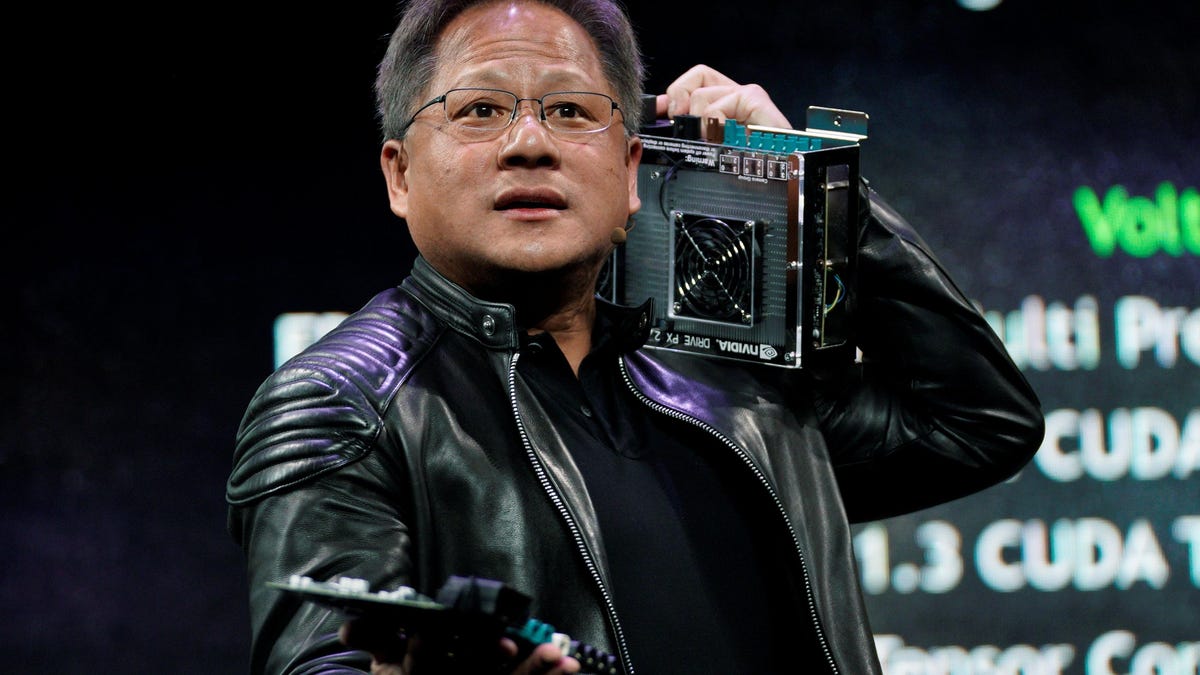

Emphasis on AI Dominance: According to Chris Fasciano, Portfolio Manager at Commonwealth Financial Network, the focus this week revolves solely around Nvidia’s earnings report.

Being synonymous with all things AI, Nvidia is under the spotlight as analysts scrutinize the implications of the earnings report on the company’s future trajectory and earnings potential. It has undeniably emerged as a standout performer in the stock market landscape.

Analyst Joseph Moore from Morgan Stanley foresees a robust quarter aligning with prevailing expectations. While acknowledging mixed data points, Moore underscores the ones closely linked to end demand as the most robust, attributing the varied supply-chain data to non-GPU bottlenecks and product cycle shifts from H100 to H200 and B100. Moore’s forecast for Q4 revenue stands at $21 billion.

Data Center Dominance: The Data Center segment continues to be Nvidia’s primary revenue driver, followed by Gaming. In Q3, Data Center revenue soared by 206% year-over-year and 34% sequentially to reach $18.12 billion (constituting 80% of the total revenue), driven by strong sales of the NVIDIA HGX platform catering to training and inferencing in extensive language models, recommendation engines, and generative AI applications.

Analyst Rick Schafer from Oppenheimer predicts a 390% annual growth in Data Center revenue for the fourth quarter, primarily led by AI accelerators. Schafer delineates the end market as 50% Cloud Service Providers, 30% consumer internet companies, and 20% enterprises.

While Schafer anticipates a 5% sequential decline in Gaming revenue, he projects a 48% year-on-year growth. He highlights a potential inflation in Gaming GPU demand due to Chinese cloud repurposing for AI workloads.

The Auto segment, contributing 1% to the revenue, might witness a 2% sequential rise but a 9% decline year-on-year. Despite the launch of Level-3 ADAS vehicles, Schafer notes that Nvidia’s Orin chip has secured design wins with major Chinese EV OEMs in 2023.

Future Prospects: The market’s outlook for the first quarter indicates an expectation of \(4.99 EPS and \)22.11 billion in revenue, with Morgan Stanley slightly surpassing the consensus at $22.8 billion.

Nvidia Stock Performance: Julian Emanuel from Evercore ISI succinctly captures the market’s reliance on Nvidia, referring to it as “NVDA, The Stock That Is The Market,” with the upcoming earnings report on 2⁄21 likely to stir FOMO sentiments, as observed since the surge of GenAI in early 2023.

Nvidia’s stock has surged by 40.25% year-to-date, outperforming major ETFs such as the SPDR S&P 500 ETF Trust SPY, Invesco QQQ Trust

QQQ, and the iShares Semiconductor ETF

SOXX, following a remarkable 240% increase in 2023.

Benzinga

Source: Benzinga

After reaching an all-time high of $746.11 on Feb. 12 and securing the position of the fourth-most valued global company, Nvidia’s stock has retraced due to concerns over earnings, slipping to the sixth position in terms of market capitalization.

Moore from Morgan Stanley anticipates additional catalysts beyond earnings, expecting insights into new products at the March graphics technology conference.

© 2024 Benzinga.com. Benzinga does not offer investment advice. All rights reserved.