Investors are eagerly anticipating Nvidia’s earnings report after the bell on Wednesday. The burning question on everyone’s mind is whether the Nvidia bubble will eventually burst.

Tarek El Moussa’s journey from debt to millionaire | Your Wallet

Before delving into the future trajectory of the AI chipmaker, it’s crucial to assess its current performance, key success factors, and the looming threats it faces.

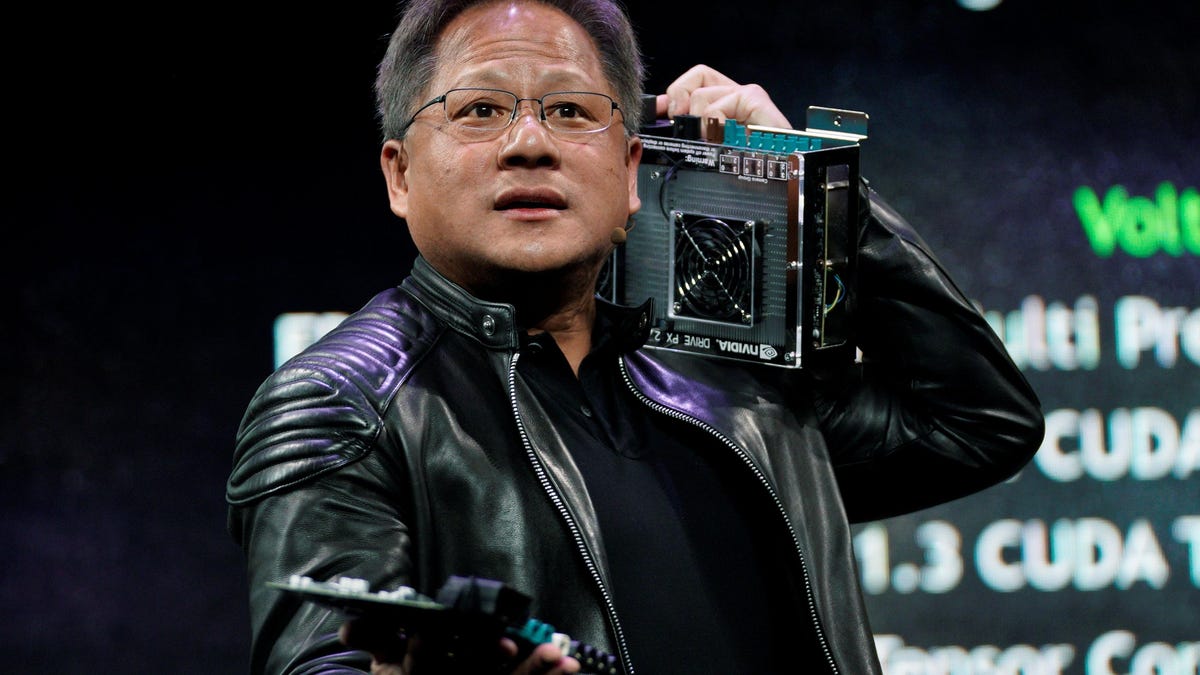

Nvidia: Powering Big Tech’s AI Revolution

Nvidia’s H100 GPUs, the high-priced chips driving generative AI technologies, have sparked a buying frenzy among major tech giants. Leading the pack are Microsoft and Meta, each splurging $4.5 billion on these chips last year, closely followed by tech behemoths like Google’s parent company Alphabet, Amazon, and Oracle.

Unlike many tech firms, Nvidia stands out as a profitable player in the generative AI realm. Apart from catering to corporate clientele, the company also supplies chips to governmental entities such as those in France and India.

Analysts’ Optimism: Projecting Tripling Revenues

According to Wall Street analysts surveyed by FactSet, Nvidia is anticipated to unveil fourth-quarter revenues of \(20.4 billion, a colossal leap from its \)6 billion sales figure in 2022, exceeding triple the growth.

Keith Lerner, chief market strategist at Truist Advisory Services, highlighted, “When people mention a thriving market this year, they are essentially referring to the tech sector, with Nvidia positioned at the forefront of this surge,” in a recent interview with Reuters.

Impressive Stock Surge: Up by 200% in the Past Year

Despite a temporary dip to \(677 on Tuesday, Nvidia’s stock price has soared by a remarkable 200% over the last year. Although the company witnessed a loss of \)78 billion in market capitalization, its stock value still hovers around 40% higher than at the start of the year and a staggering 200% increase from a year ago. At one juncture last week, Nvidia claimed the title of the third most valuable company in the U.S., surpassing the likes of Amazon and Alphabet.

Growing Competition and Emerging Rivals

The landscape is evolving with tech giants like Microsoft, Google, Amazon, and Meta venturing into the development of proprietary AI chips, posing a formidable challenge to Nvidia’s dominance. Concurrently, competitors in the chip manufacturing sector are narrowing the gap. In December, AMD unveiled a potentially more cost-effective alternative to Nvidia’s H100 GPUs, while Intel’s Gaudi3 is swiftly emerging as another contender in the market.

Doubts Looming Over Nvidia’s Future

Analysts at D.A. Davidson have raised concerns over Microsoft’s foray into developing its own GPUs and its openness to sourcing from Nvidia’s competitors as cautionary signals for the company’s prospects. Setting competition aside, skepticism exists regarding the exuberance surrounding Nvidia.

In a report issued in January, the D.A. Davidson analysts cautioned, “The inflated expectations and resulting exaggerated valuation of the business make it challenging for us to recommend purchasing the stock at its current price levels.” Drawing parallels to the dot-com bubble era, the analysts likened Nvidia to Cisco Systems, hinting at a potential bubble burst.

Echoing similar sentiments, experts from Research Affiliates, an investment research firm, expressed reservations last year, asserting that while Nvidia and AI are undoubtedly here to stay, they are presently overvalued. The firm noted, “Nvidia’s valuation reflects an unwavering belief in its CPU architecture’s continued supremacy, ruling out displacement by new players or internal initiatives at rival AI firms, and an assumption that prevailing market expectations are not overly optimistic.”

Adding to the predicament is the fact that even a slight earnings miss vis-à-vis forecasts could trigger a sharp decline in Nvidia’s stock value, given the lofty analyst projections.