2024’s Strong Start and Promising Outlook

The year 2024 has commenced on a positive note with significant gains in the major averages, including the S&P 500 and the Nasdaq composite, both showing an uptick of approximately 5%. These advances build upon the substantial growth witnessed in the previous year, setting the stage for a promising period ahead for numerous high-quality stocks.

Since the onset of 2024, some standout selections in my portfolio have been Nvidia (NVDA), AMD (AMD), Palantir (PLTR), Super Micro (SMCI), among others. The remarkable surge in various AI-related tech stocks has propelled the “AWP” tech segment of my all-weather portfolio to soar by an impressive 20% Year-to-Date (YTD).

AWP 2024 Year-to-Date Performance Overview

The All-Weather Portfolio (The Financial Prophet)

The diversified stock and ETF segment have seen a rise of approximately 10%, while the Bitcoin and digital asset sector has surged by close to 30%. On the flip side, gold and silver mining stocks (GSMs) have experienced a decline of around 11%. Nonetheless, there are indications that the downward trend in gold may be nearing its bottom, hinting at a potential rebound in GSMs in the near future.

The overall AWP performance stands at an 8% increase YTD, with the year-end return target holding steady at 30-40%. Forecasts predict the S&P 500 to conclude 2024 around 5,800 and the Nasdaq at approximately 20,000, pointing towards a significant year ahead for AI advancements benefiting various sectors including companies, government entities, and the broader economy.

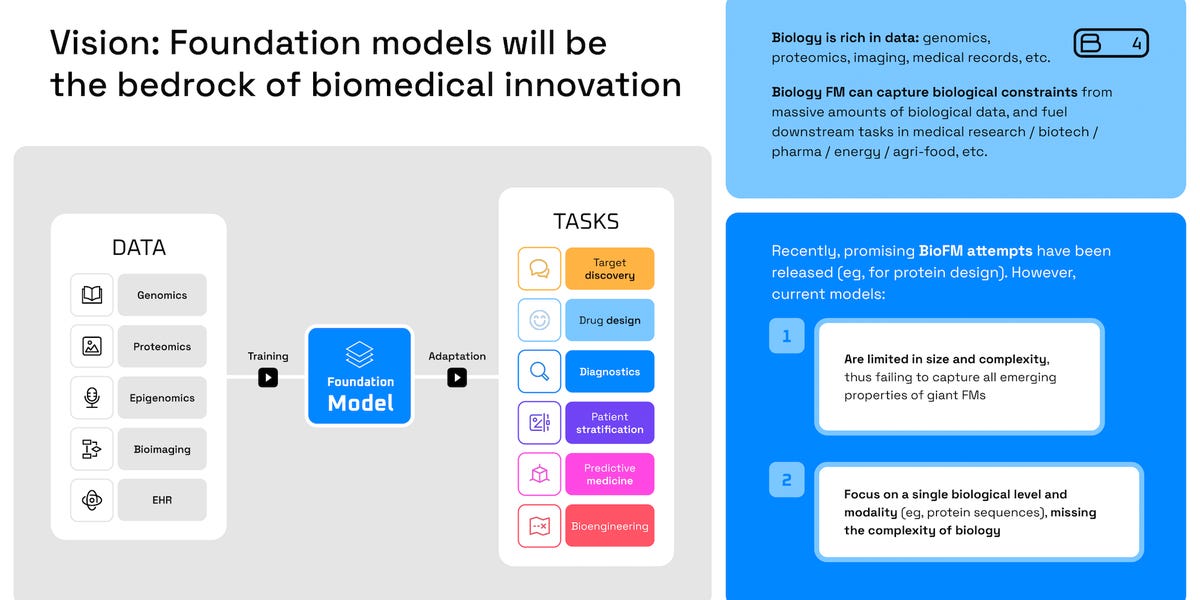

AI Market Expansion: Unveiling the Potential

AI Market Size Projections (Precedence Research)

The enormity of the AI landscape presents a staggering opportunity, with forecasts indicating a growth trajectory from roughly \(538 billion in the previous year to over \)1.8 trillion by 2030, showcasing an estimated 19% Compound Annual Growth Rate (CAGR) through 2032. This projection underscores the nascent stage of the AI domain, suggesting that top-tier AI-focused companies are poised for substantial growth in the forthcoming years.

The integration of AI is set to enhance operational efficiency within corporate realms, leading to improved margins, profitability, and heightened Earnings Per Share (EPS). The proliferation of AI-driven sales is anticipated to fuel revenue expansion for many enterprises, positioning current AI frontrunners to evolve into future juggernauts generating substantial revenues and profits.

The compounding revenue growth from heightened AI-related sales and EPS enhancement through AI-driven optimization is expected to trigger multiple expansions. This phenomenon could potentially elevate the valuation of “medium growth” stocks currently trading at around 20-25 earnings to levels of 30-35 times forward Price-to-Earnings (P/E) ratios or even higher in the years to come. Furthermore, the prospect of a more accommodative monetary policy from the Federal Reserve could amplify the effects of multiple expansions.

Impending Rate Adjustments and Economic Implications

The Federal Reserve is anticipated to implement rate cuts in the near future, with probabilities now leaning towards a potential adjustment by June, supported by a 75% likelihood of the Federal Open Market Committee (FOMC) introducing at least one rate decrease by June 12.

Rate Adjustment Probabilities (CME Group)

Recent upticks in the Producer Price Index (PPI) and Consumer Confidence Index (CCI) are perceived as transitory and may not signal a sustained inflationary trend. Any minor resurgences in inflation are deemed as part of the natural fluctuation, with the current slightly elevated Consumer Price Index (CPI) and PPI readings unlikely to prompt a return to tightening measures by the Fed. Instead, lower-than-expected inflation figures could pave the way for a more accommodative monetary policy, favoring risk assets, particularly high-quality stocks.

Top Five AI Selections

1. Palantir

2. Super Micro Computer

3. Nvidia

4. AMD

5. Tesla

These top picks reflect a strategic focus on companies well-positioned to leverage the burgeoning AI landscape for substantial growth and market dominance. Each entity presents unique strengths and growth prospects within the evolving AI ecosystem, underpinning their potential for significant value appreciation in the foreseeable future.

Exploring a New AI Entrant: SoundHound AI

SoundHound AI has recently garnered attention with a notable 75% surge, fueled by strategic investments from industry giants like Nvidia and SoftBank. The company’s innovative voice AI platform, coupled with its strategic partnerships, positions it for remarkable growth in the expanding global AI voice generator market, slated to reach approximately $4.9 billion by 2032 at a 15.4% CAGR.

AI Voice Market Expansion (Market.us)

SoundHound AI’s current trajectory indicates substantial growth potential, supported by real revenues and a positive growth outlook. With an estimated \(70 million in sales for the current year and projections nearing \)100 million by 2025, SoundHound AI trades at approximately ten times forward sales expectations, hinting at significant upside potential in the coming years.