Summary of Recent Market Movements

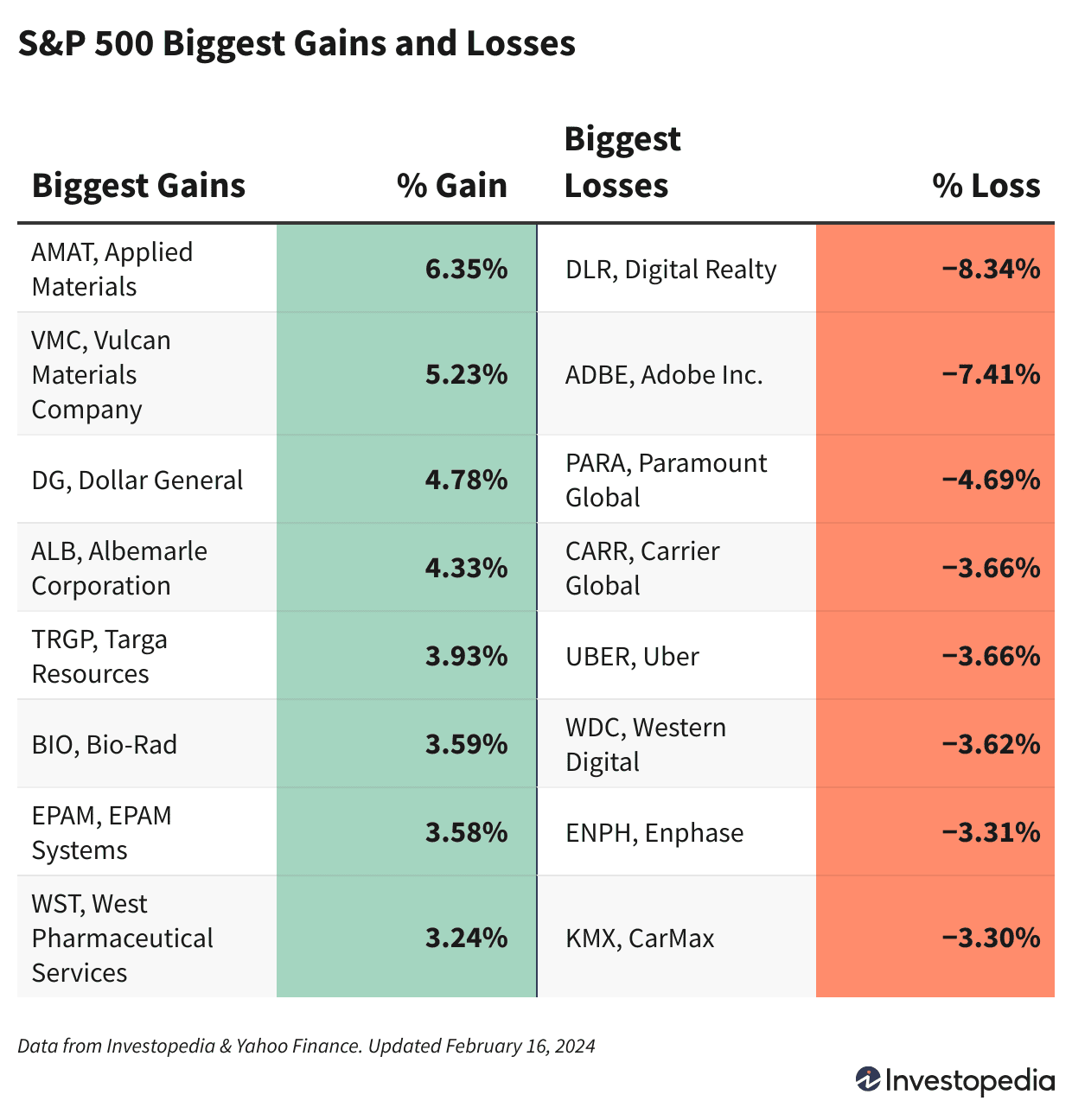

- The S&P 500 experienced a 0.5% decline on Friday, February 16, 2024, following a report indicating higher-than-expected wholesale price increases in January.

- Digital Realty Trust saw a significant drop in its stock value after reporting lower-than-anticipated quarterly funds from operations.

- Applied Materials, a semiconductor equipment manufacturer, surpassed profit and sales projections due to robust AI-driven demand, leading to a surge in its share price.

The U.S. stock market faced downward pressure on Friday due to the Producer Price Index (PPI) data revealing a greater-than-anticipated rise in wholesale prices during January. This report heightened worries about the sustainability of decreasing inflation trends, which were highlighted earlier in the week with unexpected consumer price increases.

On Friday, the S&P 500 recorded a 0.5% decrease, resulting in a weekly loss, although it maintained levels above 5,000, a milestone reached the previous week. Both the Dow and Nasdaq also experienced declines for the day and week.

Digital Realty Trust (DLR), a real estate investment trust (REIT), led the S&P 500 in losses on Friday, with an 8.4% drop in share value following disappointing quarterly revenue and funds from operations (FFO) figures.

Adobe (ADBE) shares declined by 7.4% after the launch of Sora, a text-to-video generator by OpenAI, known for ChatGPT. This innovative product, capable of generating lifelike videos from basic text prompts, poses potential competition to Adobe’s Creative Cloud software suite.

Paramount Global (PARA) witnessed a 4.7% decrease in share value after Warren Buffett’s Berkshire Hathaway (BRK.A) reduced its holdings in the entertainment company by approximately 30 million shares, as per Berkshire’s 13-F filing, leaving a remaining position of about 63 million shares.

Applied Materials (AMAT) emerged as the top performer on the S&P 500 on Friday, with a 6.3% increase in share price. The company exceeded sales and profit expectations for the fiscal first quarter, also providing an optimistic outlook for the current quarter due to heightened demand from clients focusing on AI chip production.

Vulcan Materials (VMC) observed a 5.2% rise in share value after surpassing revenue and earnings per share (EPS) estimates for the fourth quarter. The company benefited from increased prices, with a 15.8% rise in its freight-adjusted sales price per ton throughout 2023.

Albemarle (ALB) experienced a 4.3% increase in share value after surpassing revenue and earnings forecasts in the fourth quarter as the largest lithium producer globally. The company announced cost-cutting measures despite revising down its 2030 demand projections.

For news tips, kindly contact Investopedia reporters via email at tips@ investopedia.com