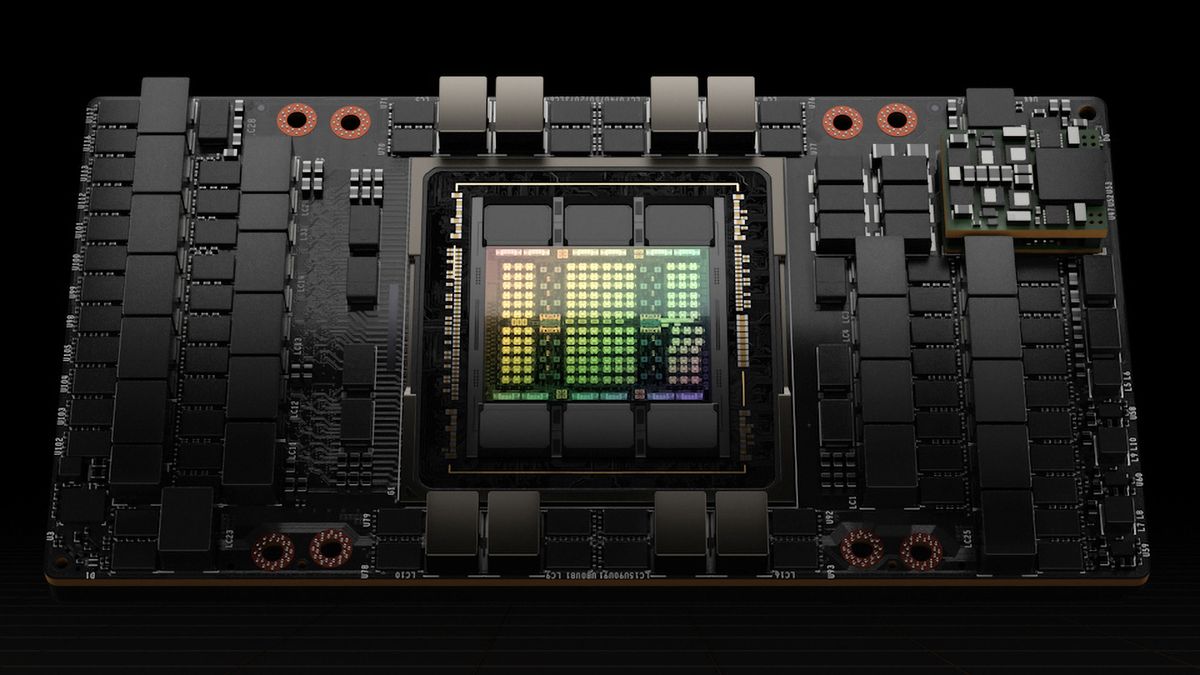

In a recent communication to its clientele, UBS, an analyst firm, has reported a significant reduction in the lead time for Nvidia’s highly sought-after H100 80GB GPU designed for AI applications. The wait time has decreased from 8-11 months to just 3-4 months, as highlighted by SeekingAlpha. This adjustment in lead times indicates a potential peak in short-term growth for Nvidia but could also hint at challenges for its future expansion prospects. Nevertheless, UBS has raised its outlook on Nvidia by revising its earnings projections and target price to $850.

The shortened lead times present a dual impact. On one side, it signifies an enhancement in Nvidia’s production partner TSMC’s CoWoS packaging production capacity, which was previously restricting the supply of H100 and other advanced processors essential for AI applications. This expansion translates to improved supply chain efficiency and faster order fulfillment, potentially leading to increased revenue and earnings in the short run. Conversely, as lead times near zero, Nvidia may shift from fulfilling existing backlogs to focusing solely on new orders, which could result in a revenue decline.

TSMC has announced plans to enhance CoWoS capacity by the conclusion of 2023 and to double the capacity from mid-2023 levels by the end of 2024. The accelerated progress in the expansion of CoWoS capacity at TSMC or its OSAT partners might be a key factor contributing to the reduced lead times for the H100 GPU.

However, the inability of Nvidia to deliver fully-enabled H100 units to China due to U.S. restrictions has reportedly led to a reduction in demand in the Chinese market. This situation may have prompted Nvidia to redirect excess H100 inventory to other regions. While China represents a substantial portion of Nvidia’s revenue, it remains uncertain whether the decreased shipments to China have directly influenced the reduction in lead times from 8-11 months to 3-4 months.

Although the current market outlook predicts sustained growth for Nvidia with no anticipated quarter-on-quarter revenue declines until January 2026, the rapid decline in lead times suggests a potential cooling off of this growth sooner than expected, possibly within the next two to three quarters. Analysts caution that this scenario is not currently factored into the stock’s valuation, which presently assumes uninterrupted growth.

Despite the likelihood of a slowdown in Nvidia’s growth trajectory, it is crucial to recognize that the overall AI capacity will continue to expand. Nvidia’s product deliveries will contribute to the increasing deployment of GPUs, while other competitors will also play a role in this expansion. Consequently, although Nvidia’s sequential growth may encounter obstacles, the broader AI industry is poised to progress continuously.