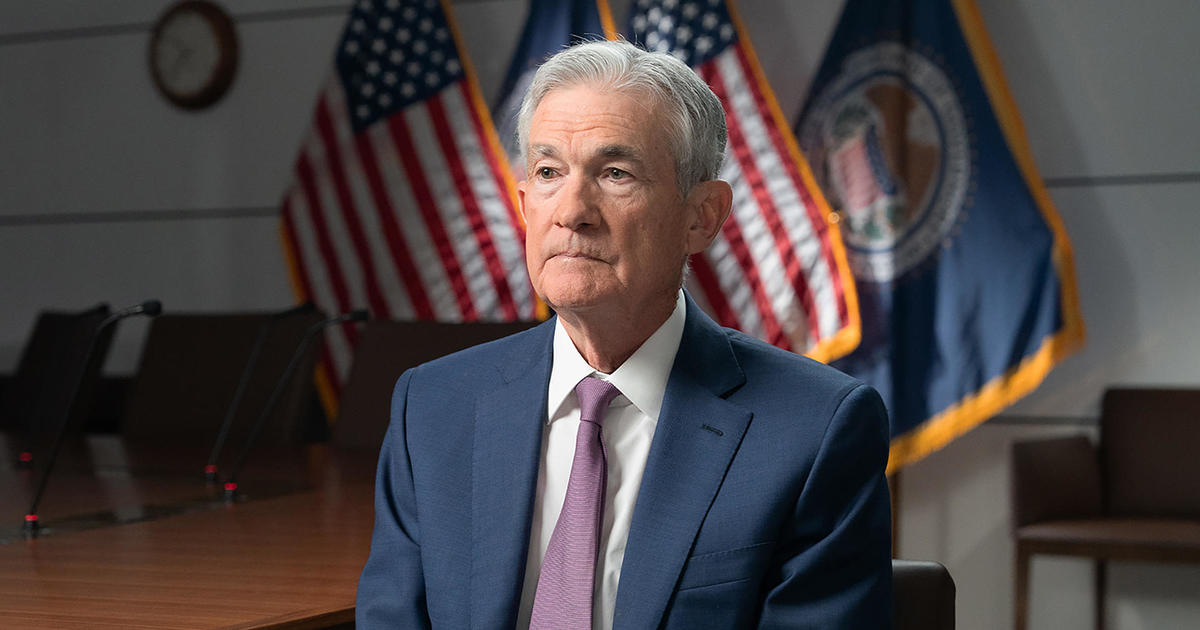

This week on 60 Minutes, Scott Pelley interviewed Jerome Powell, the chairman of the Federal Reserve, discussing the state of the U.S. economy following a 40-year record high inflation that prompted the Fed to raise interest rates 11 times to stabilize the economy.

Over the past 11 months, inflation has been on a steady decline, while employment rates have reached a near 50-year high. Despite these positive trends, Powell recently announced that the Federal Reserve would maintain the federal interest rate at 5.25 – 5.50% for the time being but hinted at a potential rate cut later in the year.

During the interview with 60 Minutes correspondent Scott Pelley in the Federal Reserve Board Room, Powell expressed growing confidence among the 19 participants in considering a federal funds rate cut within the year.

Chairman Powell also delved into the Federal Reserve’s exploration of the economic implications of artificial intelligence, the implementation of new regulations to prevent incidents similar to the Silicon Valley Bank failure, and the collapse of China Evergrande, a heavily indebted Chinese real estate company.

Cybersecurity

Addressing the issue of cyber threats to the American banking system, Powell emphasized the importance of continuous vigilance and investment in defense mechanisms to counter evolving cyber threats effectively. He highlighted the necessity for banks to stay ahead of attackers by consistently upgrading their security measures.

Silicon Valley Bank Failure

In March 2023, Silicon Valley Bank faced a sudden closure after experiencing a massive withdrawal of funds triggered by social media and mobile banking influences. Powell acknowledged the need for enhanced bank supervision and regulatory measures to prevent a recurrence of such events.

China Evergrande and China’s Economy

The recent liquidation order against China Evergrande, a major real estate player in China, due to its failure to restructure a substantial debt of \(300 billion, including \)25.4 billion owed to foreign creditors, raised concerns about China’s economic stability. Powell noted the challenges facing China’s economy, particularly its heavy reliance on real estate investments.

Geopolitical Risks and the Global Economy

Powell identified “geopolitical risks,” such as conflicts in Ukraine and the Middle East, as significant threats to global economic stability. While the U.S. has not felt the full impact of these conflicts yet, Powell warned of potential economic repercussions if these risks escalate.

Immigration and the Job Market

Powell highlighted the role of immigration in stabilizing the U.S. labor market, noting that the return of immigrants to pre-pandemic levels contributed to a notable increase in labor supply. He emphasized the positive impact of immigration on the economy and its role in restoring balance to the labor market.

Artificial Intelligence Research

Powell discussed the Federal Reserve’s research on artificial intelligence and its potential effects on employment, productivity, wealth distribution, and income. The Fed aims to understand how AI will impact the economy in terms of enhancing productivity and workforce dynamics.

In conclusion, Powell’s insights during the 60 Minutes interview shed light on key economic issues, regulatory challenges, and technological advancements shaping the current economic landscape.