Nvidia (NVDA) is a prominent name in discussions about top artificial intelligence stocks. However, it’s essential not to overlook Synopsys (SNPS), a significant partner of Nvidia. Synopsys has already secured a place on the IBD Long-Term Leaders list, showcasing an impressive 3,594% surge from a low point in 2008 until the end of the previous year. Currently, Synopsys stock is poised to enter a new buy zone, pending favorable market conditions.

Both Synopsys and Nvidia are featured on the IBD 50, IBD Big Cap 20, and the IBD Breakout Stocks Index, boasting a stellar 99 Composite Rating each. The surge in demand for AI-related technologies has fueled institutional interest in Synopsys, evident from its robust B Accumulation/Distribution Rating. Moreover, 52 funds rated A+ by IBD have holdings in Synopsys stock.

Although not included in the top 100 stocks of 2023 like Nvidia, Synopsys delivered a notable 65% gain last year. While Nvidia has surpassed its buy range, Synopsys is gearing up for a potential breakout.

Synopsys’ Strategic Move: Acquisition of Ansys

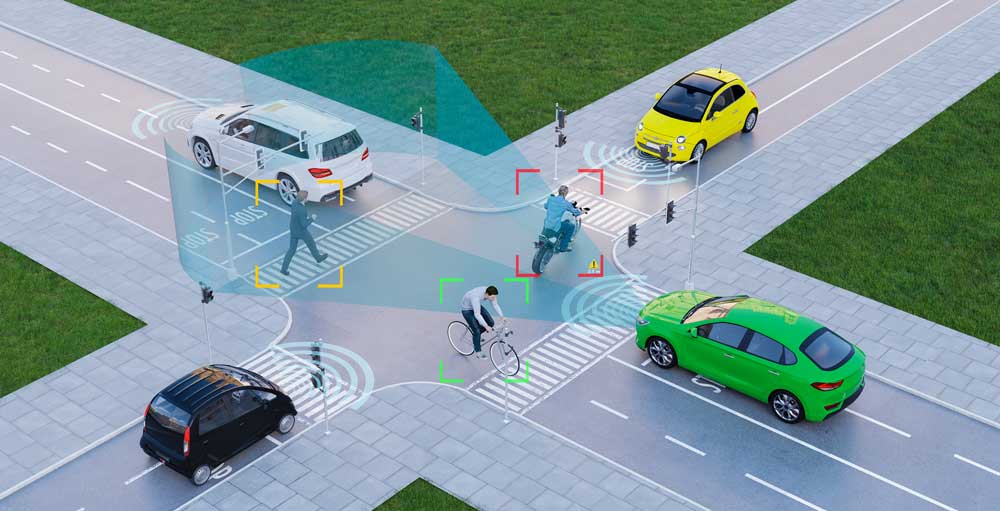

Headquartered in Sunnyvale, California, Synopsys specializes in providing software and systems for simulating and validating semiconductor designs and prototypes. Its offerings cater to self-driving vehicles, AI-powered machinery, and the essential communication infrastructure for cloud-based applications.

Apart from collaborating with Nvidia, Synopsys partners with key industry players like Taiwan Semiconductor (TSM), Arm Holdings (ARM), Intel (INTC), Samsung, and others. Recently, Synopsys revealed its acquisition of Ansys (ANSS), a company focused on engineering simulation software applications for design analysis and prototyping.

This strategic move aims to address the prevailing AI megatrends, the proliferation of silicon, and the increasing complexity of software-defined systems. The acquisition, valued at around $35 billion based on Synopsys’ closing stock price on Dec. 21, aligns with the company’s growth strategy.

Market Performance and Outlook

While Nvidia’s stock has surged past the 600 mark, maintaining its position near record highs, Synopsys stock has charted a second-stage cup with handle, with a buy point set at 554.57. Noteworthy is the stock’s strong relative strength line and the series of upswings in heavy trading volume during the formation of the right side of the base.

Despite a slight dip as the Nasdaq retraces, Synopsys remains above its 50-day moving average. The next earnings release for Synopsys is scheduled for Feb. 21. Following a successful fiscal fourth quarter where Synopsys outperformed expectations, reporting \(3.17 earnings per share (a 66% increase from the previous year) and revenue growth of 25% to nearly \)1.6 billion, the company is on a trajectory of accelerated growth.

Analysts anticipate a 39% earnings uptick for the current quarter, translating to an 83% annual gain for Synopsys stock.

IBD Breakout Opportunities ETF

For investors interested in tracking the IBD Breakout Stocks Index, the IBD Breakout Opportunities ETF (BOUT) managed by Innovator Capital Management offers a convenient option. This ETF mirrors the index’s performance, providing exposure to a diversified portfolio rather than individual stock selection.

For updates and insights, you can follow Matthew Galgani on X (formerly Twitter) at @IBD_MGalgani.