AMD released its financial results for the fourth quarter of 2023 and the entire fiscal year, revealing a strong finish driven by increased demand for its data center GPU business amidst the AI frenzy. Despite this positive performance, the company faced a setback with a lower-than-expected guidance, leading to a 6% drop in its shares during after-hours trading. Notably, AMD foresees selling $3.5 billion worth of its MI300-series AI GPUs in 2024, with assurances of no supply constraints, indicating a controlled demand scenario unlike Nvidia’s perpetual GPU shortages.

The company’s outlook for the first quarter of 2024 projects a decline in revenues from the client, embedded, and gaming segments, with a significant drop of over 30% expected in revenue from semi-custom products, primarily console SoCs. However, AMD anticipates a stable data center segment revenue, balancing the seasonal server sales dip with a substantial rise in AI and HPC GPU sales, particularly from the Instinct MI300-series products.

In retrospect, AMD’s fourth-quarter sales reached \(6.168 billion, marking a 10% year-over-year increase, while its total revenue for 2023 amounted to \)22.68 billion, down by 4% year-over-year. The company experienced a mixed performance for the year, with growth in data center processor sales offset by declines in client platform shipments and gaming hardware sales.

Financially, AMD reported a notable surge in net income, reaching \(667 million for the fourth quarter of 2023, with a significant gross margin increase to 47%. For the entire fiscal year, the company earned \)854 million in net income, reflecting a 35% decline year-over-year, alongside a 1% rise in gross margin to 46%.

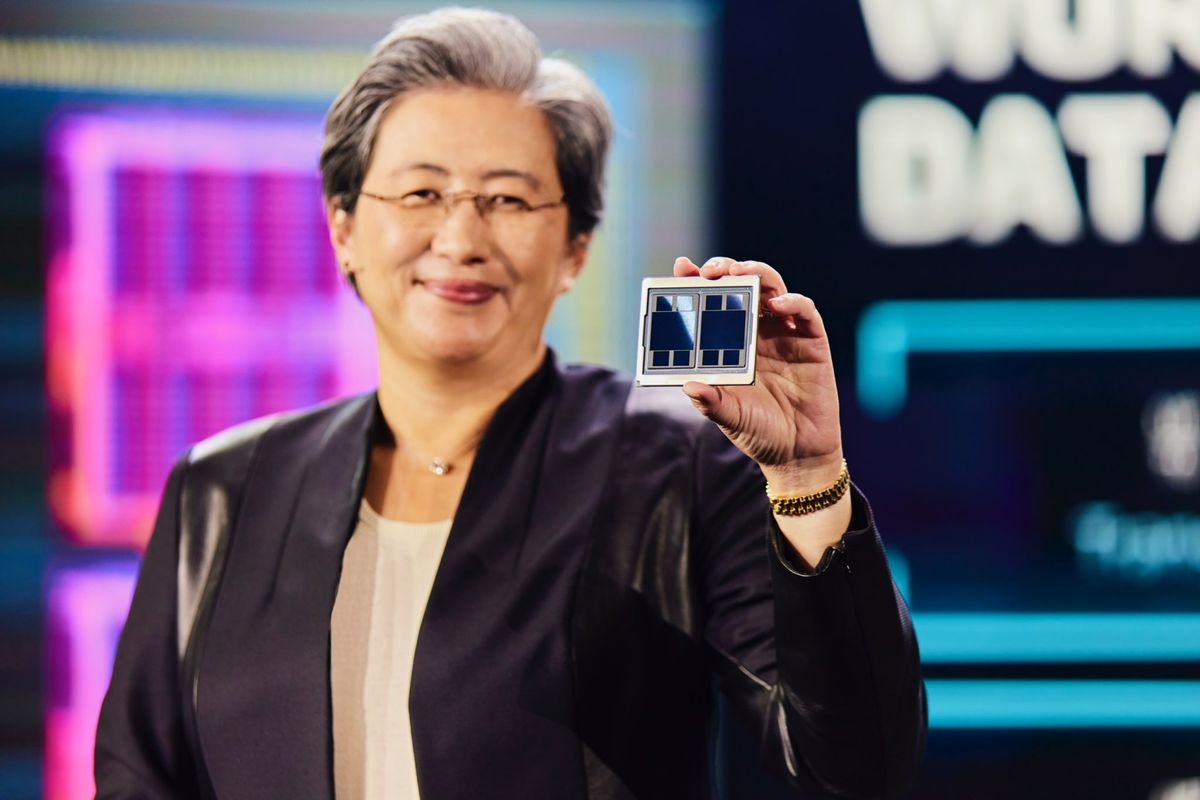

Lisa Su, AMD’s CEO, expressed satisfaction with the company’s performance, highlighting record sales of AMD Instinct GPUs, EPYC CPUs, and Ryzen processors, driven by the escalating demand for high-performance data center products in the evolving landscape of AI technology.

In the realm of data center platforms, AMD achieved record-breaking results in Q4 2023, with \(2.282 billion in revenue and \)666 million in operating income. The year-end figures for the data center division showed a 7% revenue increase to $6.496 billion, despite a 31% decline in operating income.

Conversely, the client business unit saw a revenue boost to \(1.461 billion in Q4 2023, attributing the growth to the recovery of the PC market and successful sales of the latest Ryzen processors. However, the client PC business witnessed a 25% decline for the year, resulting in a loss of \)46 million, contrasting sharply with the previous year’s operating income of $1.19 billion.

The gaming hardware segment faced challenges, with a 17% revenue drop in Q4 2023 and a decrease in operating income to \(224 million. The full-year revenue declined by 9% to \)6.212 billion, primarily due to reduced sales of processors for consoles.

In the embedded segment, revenue decreased by 24% to \(1.057 billion in Q4 2023, largely due to customer destocking, despite maintaining profitability with \)461 million in net income. However, the segment witnessed a significant 17% annual revenue growth to $5.3 billion, bolstered by the acquisition of Xilinx.

Looking ahead, AMD’s cautious outlook for the first quarter of 2024 forecasts revenues around $5.4 billion, with a flat data center segment revenue and sequential declines in client, embedded, and gaming segments. The company remains optimistic about AI and HPC GPU sales, particularly from the Instinct MI300-series products, aiming to navigate through the anticipated challenges with strategic resilience and innovation.