The payments industry is undergoing a transformation with the introduction of artificial intelligence, revolutionizing how consumers make payments for products and services.

AI-driven payments streamline processes, combat fraud, and elevate the overall payment experience for consumers, as outlined in the PYMNTS Intelligence report titled “AI-Enabled Payments Enhance Customer Options.”

Many consumers engage in AI-related activities without full awareness. For example, over 80% of consumers utilize AI for online searches, 52% rely on AI for navigation, and 52% receive AI-generated product recommendations, according to research findings.

In terms of gender, around 46% of men and 33% of women demonstrate significant familiarity with AI, with younger age groups showing a higher level of comfort and knowledge compared to older demographics.

Notably, Generation Z individuals exhibit a strong familiarity with AI, with 65% considering themselves very or extremely knowledgeable about the technology. Millennials also show considerable awareness and interest, with 51% claiming high familiarity with AI.

Income level also influences AI awareness, with nearly half of consumers earning over $100,000 annually being very or extremely familiar with AI, despite concerns about potential overreliance on the technology within this group.

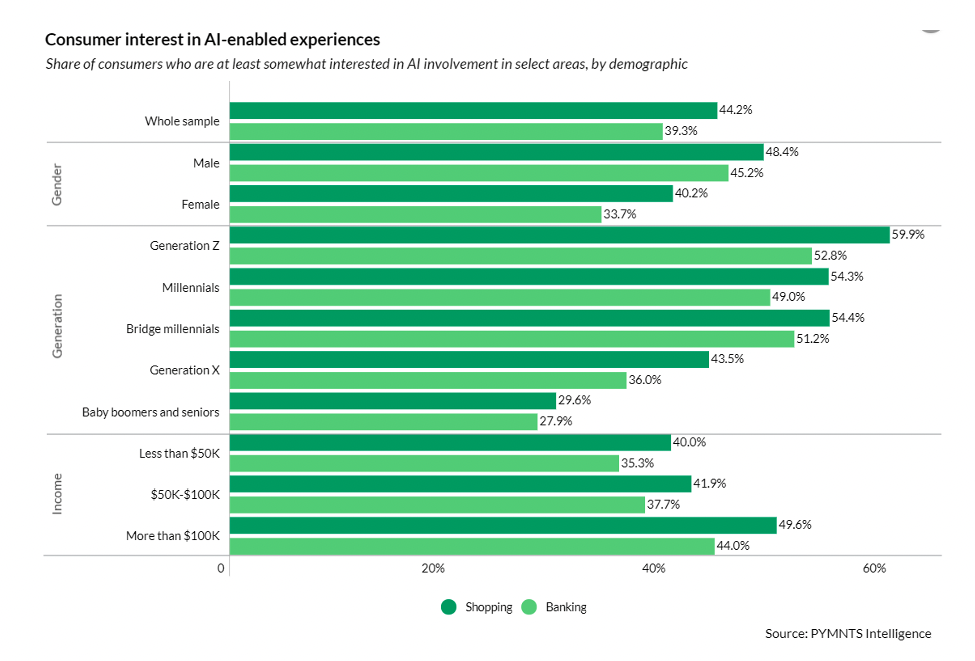

Different generational cohorts display varying preferences and comfort levels when it comes to integrating AI into personal activities. Gen Z, millennials, and bridge millennials display heightened interest in AI-driven shopping experiences, while Gen X shows lower-than-average familiarity with AI. This trend extends to AI-powered banking as well.

Overall, consumers across different demographics exhibit a stronger inclination towards AI involvement in shopping activities (44%) compared to banking (39%), regardless of age, gender, or income.

Breaking down the data by age group, nearly 60% of Gen Z consumers express a keen interest in AI-powered shopping, while 53% show interest in AI-driven banking services. This pattern is consistent across all age brackets.

Further insights reveal that a larger percentage of women (40%) express some level of interest in AI’s role in shopping compared to banking, a trend mirrored by men. Moreover, a significant portion of high-income earners prefer AI-driven shopping experiences over banking services.

The report also highlights that younger consumers, like Gen Z, exhibit some reluctance towards credit usage, possibly due to economic circumstances and concerns about high fees and interest rates. However, AI has the potential to shift this behavior by assisting them in identifying optimal payment solutions aligned with their preferences and objectives.

Businesses that adopt AI are not only reshaping current customer service practices but also driving the growing demand for AI-based payments in the future.

To ensure widespread adoption of AI benefits among diverse customer segments, service providers must embrace a flexible and inclusive approach, customizing features to cater to varied customer preferences actively.