Wednesday’s Designated Stock: Advanced Micro Devices (AMD)

The highlighted stock for Wednesday is Advanced Micro Devices (AMD), currently striving to break free from a minor handle. As AMD positions itself in the expanding realm of artificial intelligence, its stock has surged by over 90% during this period.

Based in Santa Clara, California, AMD competes with Intel (INTC) in the production of central processing units (CPUs) for personal computers and servers. Conversely, in the market for graphics processing units (GPUs) catering to computers, gaming consoles, and data centers, AMD faces off against Nvidia (NVDA).

AMD’s strategic focus lies within the thriving AI chip sector, driven by the exponential growth of conceptual AI applications—a domain currently dominated by Nvidia. The company is gearing up to unveil new AI innovations at an upcoming event.

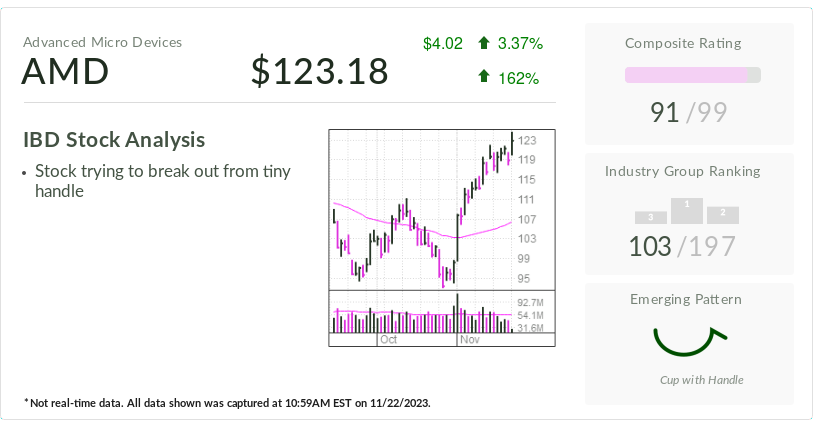

In the latest market activity, AMD’s stock is up by 3.5% at 123.29. Since the release of the company’s earnings report on October 31, there has been a remarkable 20% surge, forming a cup-with-handle pattern with a 122.11 buy point.

Performance Metrics for AMD Stock

In its most recent Q3 report, AMD disclosed earnings of 70 cents per share on a revenue of \(5.8 billion for the previous quarter. Analysts surveyed by FactSet had predicted earnings of 68 cents per share on a revenue of \)5.7 billion. Both revenue and earnings exhibited a 4% annual increase.

Despite a year-over-year revenue dip for AMD, the third-quarter results marked the conclusion of a three-quarter downward trend.

Although AMD fell short of economists’ projections with \(6.1 billion in sales for the latest quarter, the company’s forecast of over \)2 billion in MI300 AI accelerator sales in 2024 served to mitigate the shortfall.

The MI300 accelerator, unveiled in June, aims to rival Nvidia’s cutting-edge H100 chips, with its official launch scheduled for December 6.

As per Chief Financial Officer Jean Hu’s statement from October 31, “We anticipate robust growth in the data center and sustained momentum in customer, partially offset by reduced gaming sector sales and further softening of demand in embedded markets.”

AI Advancements

Goldman Sachs analyst Toshiya Hari noted that the 2024 sales forecast “bolsters the belief that AMD is well-positioned to tap into the vast and expanding Gen AI compute market.”

NVDA, the top performer in the S&P 500, has excelled in providing chips for relational AI, propelling its shares to a 230% increase this year. Nvidia recently announced profits that exceeded Wall Street’s lofty expectations. However, NVDA’s stock saw a 2% decline in subsequent trading.

Looking ahead to next month, AMD’s stock may witness a catalyst. On December 6, AMD is set to host an “Advancing AI” event to introduce its MI300 innovations. The event, as per AMD’s press release, will also “showcase the company’s growing traction with AI hardware and software enthusiasts.”

Technical Assessment of AMD Stock

According to the IBD Stock Checkup, AMD ranks third out of 37 stocks in the fabless silicon companies category, with NDA leading the pack.

Furthermore, AMD boasts an IBD Relative Strength Rating of 94 out of 99. This rating reflects how the fund’s price performance over the past 52 weeks stacks up against that of other companies. RS Ratings of 80 or above are typical for top growth companies.

AMD’s stock holds an IBD Rating Composite of 91 out of 99. The Rating Composite amalgamates five distinct proprietary ratings into a single score. Superior growth stocks typically exhibit a Rating Composite of 90 or higher.

Additionally, AMD’s stock is part of the IBD Tech Leaders roster.