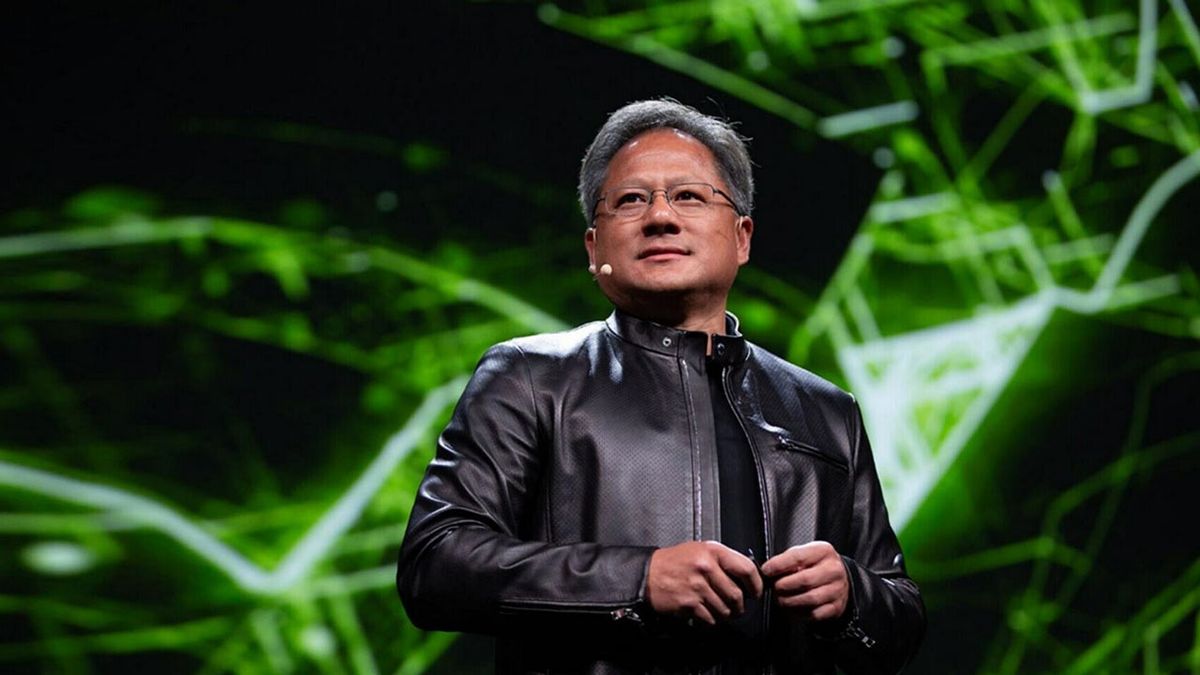

Jensen Huang, the founder and CEO of Nvidia, has significantly increased his wealth due to a substantial surge in the company’s stock value, as reported by Business Insider. At the start of 2023, Huang, whose net worth was estimated at approximately \(14 billion, now ranks as the 27th wealthiest individual globally, with a net worth of nearly \)44 billion, primarily attributed to his significant holdings of Nvidia shares. While Nvidia is renowned for producing top-tier graphics cards, the recent surge in value is predominantly linked to Artificial Intelligence (AI) rather than gaming graphics.

During the COVID-19 pandemic in 2020 and 2021, Nvidia experienced a surge in its valuation, making Huang already a valuable figure. However, in 2022, there was a notable decline in share prices, especially for tech companies like Nvidia. The peak for Nvidia’s stock price was recorded on November 30, 2021, at \(326, plummeting to \)21 by September 30, 2022.

Nonetheless, Nvidia’s stock has witnessed a remarkable upswing this year, currently standing at a 237% increase from the beginning of the year. This surge is largely fueled by the excitement surrounding AI and its competitive capabilities. Nvidia’s pioneering position in AI, courtesy of its Tensor components and AI program, has positioned it as the primary beneficiary of this investment frenzy.

The market’s admiration for Nvidia is well-founded, notwithstanding occasional discrepancies in stock valuations. In Q2 of this year, Nvidia achieved record-breaking revenues, surpassing \(13 billion compared to the previous high of \)8 billion. The soaring demand for AI technology propelled the data center segment alone to generate $10 billion in revenue, surpassing Nvidia’s historical gaming GPU revenue.

While Nvidia is reaping substantial financial rewards from the AI boom, other tech giants like AMD, Microsoft, Meta, and even Intel, despite recent struggles, have also experienced notable stock price surges of 81%, 54%, 175%, and 63%, respectively, since the beginning of the year.

Huang’s wealth remains intricately tied to Nvidia’s stock performance, even if he refrains from selling his shares in the company. Any fluctuations in Nvidia’s market value due to doubts regarding the commercial viability of AI or concerns about overvaluation could significantly impact Huang’s fortune. Additionally, export restrictions on Nvidia’s major GPUs to China and other regions could potentially affect the company’s financial standing. The forthcoming release of Nvidia’s Q3 financial results today post-market closure carries the potential to sway investor sentiment significantly.

Despite the market uncertainties, Huang’s substantial net worth of around $13 billion in 2022 provides a comfortable cushion for his retirement, even during turbulent market conditions.