After a Wall Street analyst suggested that the company is in a prime position within the software market to translate “AI hype” into tangible revenue, Microsoft (MSFT) experienced a surge in its stock value on Monday.

Brent Thill, an analyst at Jefferies, reaffirmed his buy recommendation for Microsoft stock and raised the target price from 465 to 550. He hailed Microsoft as the foremost success story in AI among software firms.

During afternoon trading sessions today, Microsoft shares climbed by 0.7% to reach 423.72.

In a recent communication to clients, Thill expressed his belief that Microsoft is well-positioned to reap substantial benefits from Gen AI (generative artificial intelligence). He highlighted Microsoft’s advantageous position to leverage both infrastructure (Azure and OpenAI) and application opportunities (such as a series of Copilots) to capitalize on this transformative trend.

Thill indicated that investors may start positioning themselves now, even though software companies are not expected to see substantial returns from their AI investments until late 2024 or beyond.

Within the AI software market, Thill favors Microsoft and Amazon (AMZN) for enterprise applications, while in the consumer sector, he leans towards Google’s parent company Alphabet (GOOGL) and Meta Platforms (formerly Facebook). For security software, he recommends CrowdStrike (CRWD).

Thill advised investors to position themselves ahead of the anticipated surge in business adoption between late 2024 and late 2025 to better align with revenue growth prospects.

While semiconductor and hardware companies like Nvidia (NVDA) and Super Micro Computer (SMCI) have historically dominated AI investments, Thill anticipates a shift in this landscape as more industry players and gaming companies allocate resources towards enabling businesses to leverage Gen AI.

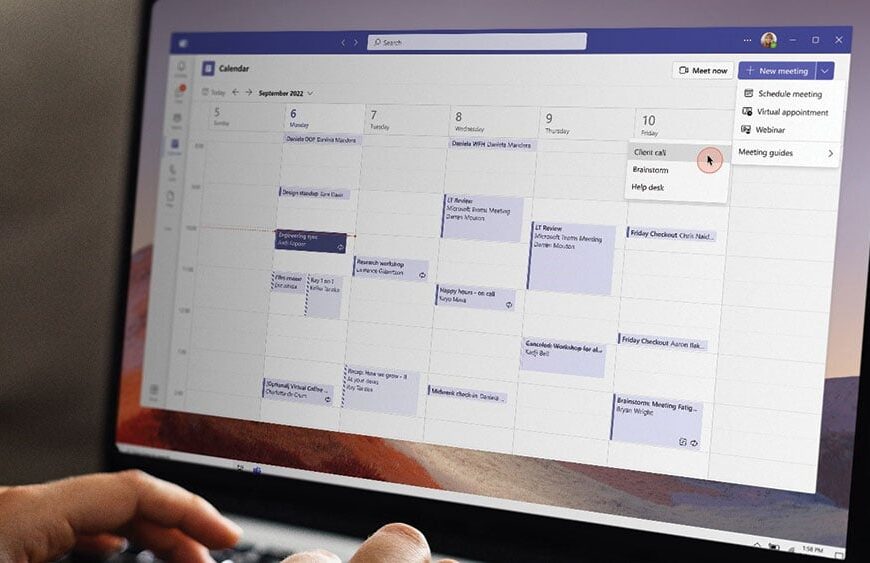

In a separate development, Microsoft revealed plans to separate its Teams chat and video conferencing technology from its Office productivity suite on a global scale. This decision, made in response to regulatory scrutiny, follows a similar move in the European Union to address potential antitrust concerns.

Additionally, reports suggest that Microsoft and OpenAI are collaborating on a significant data center initiative, estimated to cost up to $100 billion and feature a supercomputer named Stargate to support OpenAI’s AI research efforts.

Microsoft stock is included in the IBD Tech Leaders list and has demonstrated an increase of nearly 13% over time.

For further updates on consumer technology, software, and semiconductor stocks, follow Patrick Seitz on X, formerly Online, at @IBD_PSeitz.