For Datadog (DDOG) and its shareholders, the recent months have been quite eventful.

The software company’s stocks experienced a significant drop of over 17% on August 8 due to a pessimistic third-quarter outlook. However, just three months later, on November 8, the stocks surged by more than 28% following better-than-expected third-quarter results.

As Datadog navigates through a challenging period, the focus now shifts to whether Wall Street’s expectations regarding the company’s 2024 revenue growth are overly optimistic.

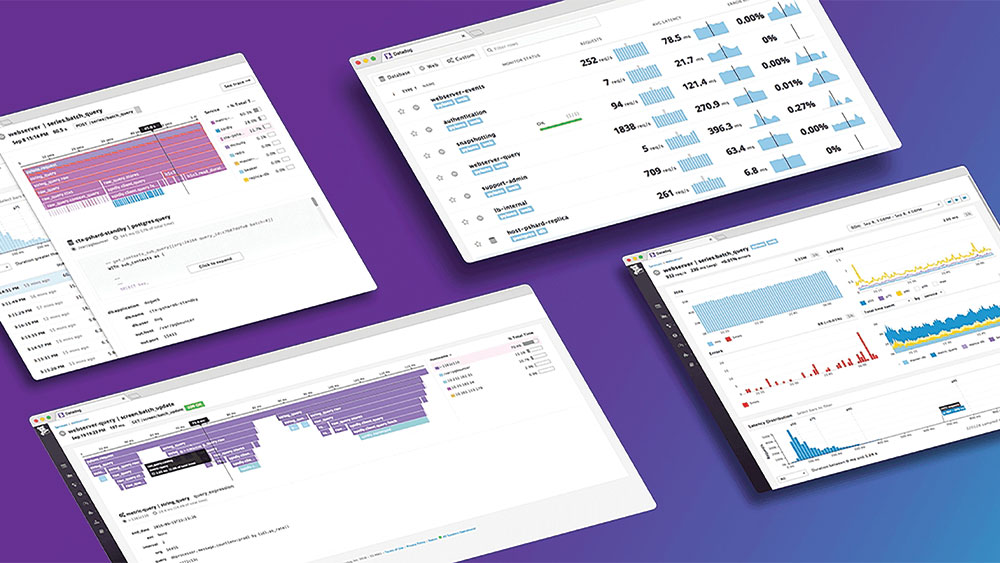

Headquartered in New York, Datadog specializes in monitoring applications using cloud computing systems, with software companies and data technology departments being its primary clientele.

Datadog’s software leverages Alphabet’s (GOOGL) Google cloud services, Microsoft Azure (MSFT), and Amazon Web Services (AMZN) from Amazon.com.

Cloud Spending Trends in Businesses

During the Covid crisis, Datadog witnessed a revenue increase of 70% in 2021 and 63% in 2022. The surge was fueled by the shift to remote work and the rise of e-commerce, emphasizing digital transformation initiatives.

However, from mid-2022 onwards, many businesses started reverting to using cloud services, often referred to as “optimization” on Wall Street. Analysts project a 26% revenue growth for Datadog in 2023, with a further slowdown to 22.5% in 2024.

Consumer behavior plays a crucial role, with Datadog generating 65% of its Q2 profits from existing clients and the remaining 35% from new ones.

Notably, the company closed a record number of new contracts exceeding $100,000,000 in the September quarter, marking the second consecutive quarter of such achievements.

Additionally, the adoption of artificial intelligence has been a boon, with both startups and established tech firms launching projects that utilize large language models.

Datadog recently disclosed its AI metrics, revealing that generative AI companies utilizing its cloud monitoring tools contribute around 2.5% to the monthly recurring revenue. The company also highlights the rapid expansion of its relational AI client base.

Founder-Led Management and Expertise

At a recent RBC Capital event, Datadog’s CFO, David Obstler, emphasized the company’s focus on developing AI tools and services for clients. The company’s founders, Olivier Pomel and Alexis Le-Quoc, bring a wealth of experience from their tenure at Wireless Generation, where they specialized in educational information systems.

Analyst Andrew Sherman from TD Cowen praised founder-led management teams with significant equity ownership aligned with shareholders’ interests.

Datadog’s executive team, including Chief Revenue Officer Sean Walters, Chief Operating Officer Adam Blitzer, and CFO David Obstler, boasts extensive experience exceeding five years in their respective roles.

Initially displacing major legacy vendors like IBM, BMC Software, and Broadcom’s CA Associates, Datadog carved its niche with a cloud-based monitoring and analytics platform.

Stock Offerings and Market Performance

Datadog faces competition from industry players like Splunk, Dynatrace, New Relic, and Cisco Systems’ App Dynamics unit.

The company’s IPO in September 2019, offering 24 million shares at \(27 each, raised \)648 million. By November 2021, Datadog’s stock hit an all-time low of 199.68.

In 2022, the stock witnessed a substantial surge, with a 48% increase in 2023 following a rebound in the third quarter.

The November 8 rally in Datadog’s stock was partly fueled by a short squeeze, a phenomenon where small traders capitalize on stock price declines by repurchasing shares at lower prices.

Tech Industry Influence on Datadog’s Client Base

Tech companies, particularly in business technology, have been Datadog’s primary customers. Financial services firms also feature prominently among its non-tech clientele.

Datadog reported that efforts to optimize consumer cloud spending have yielded positive outcomes, with Amazon and Microsoft noting improvements during their third-quarter earnings calls.

CFO Obstler highlighted the correlation between tracking cloud workloads and revenues, emphasizing Datadog’s alignment with hyperscalers and users’ interactions with the system and tools. The company remains focused on cost management and anticipates ongoing marketing efforts despite some easing in challenging areas.