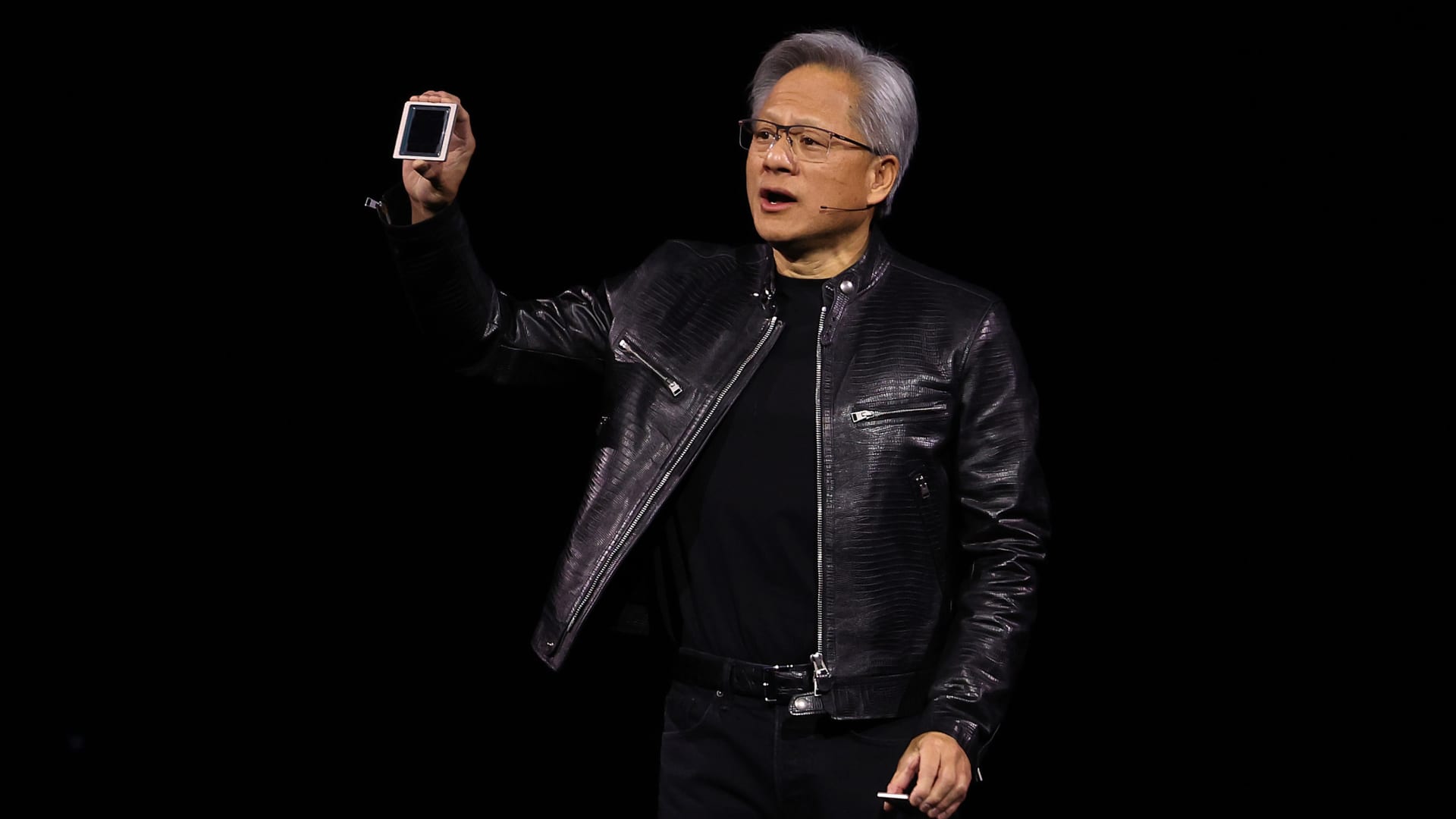

On Thursday, analysts at UBS raised the price target for Nvidia to \(1,100, up from the previous \)800, highlighting the company’s unique ability to carve out its own market niche in the tech industry.

After the recent introduction of Blackwell and active participation in various GTC sessions, UBS is optimistic about Nvidia’s (NASDAQ: NVDA) potential to tap into a new wave of demand from global enterprises and sovereign entities.

Looking ahead, UBS forecasts a substantial growth trajectory for Nvidia in the 2025 calendar year, with projected revenues nearing $150 billion, marking a notable 30% uptick.

This optimistic outlook has prompted a reassessment of both earnings projections and the price target for Nvidia.

With the debut of Blackwell and NIM, a novel software platform designed to streamline the integration of customized and pre-trained AI models into production settings, UBS analysts anticipate a surge in Nvidia’s Artificial solution offerings. They suggest that this development could accelerate the distribution of NVDA’s Artificial solutions alongside enterprise software, akin to a centralized app store structure. The potential for licensing NVDA’s AI Enterprise software at $4500 per GPU per year across a wide range of companies could lead to rapid monetization.

In response to their bullish report, a Rosenblatt analyst significantly raised the price target for Micron (NASDAQ: MU) from \(140 to \)225, indicating a potential upside of over 100% from current levels.

The analyst emphasized the role of HBM3e in addressing the DRAM structural deficit through 2025, with a substantial portion earmarked for that year. They foresee Micron making significant strides in the HBM (High Bandwidth Memory) market, projecting a market share increase from negligible to the low 20s percentage range. This growth is attributed to both supply shortages in the industry and Micron’s development of power-efficient solutions that outperform competitors.

By the conclusion of FY24, Rosenblatt anticipates a decline in chip power levels, which had peaked in FY22. This reduction could result in DRAM and NAND supply growth lagging slightly behind the anticipated increase in demand in 2024, leading to price hikes throughout the year.

Additionally, the analyst foresees a sustained upturn in the DRAM market heading into 2026, driven by the AI server sector’s transition to the more advanced HBM4 technology. The analyst explained that the accelerator compute sector, including Blackwell/Hopper, MI300, custom ASIC, and similar technologies, is heavily reliant on DRAM bit content and performance (HBM), making it highly price inelastic.

The impending memory cycle, fueled by the AI revolutionizing compute capabilities, is poised to be the most significant in history, according to the analyst.

Morgan Stanley analysts noted this week that the market may be undervaluing Apple’s Edge AI initiatives, which could serve as a growth catalyst for the stock in the future.

Reiterating an Overweight rating with a $220 price target on Apple (NASDAQ: AAPL), the analysts believe that upcoming generative AI solutions could offset other concerns, such as Chinese demand and ongoing legal challenges, potentially driving outperformance.

While acknowledging that dispelling current market apprehensions stemming from China demand and antitrust issues may take time, Morgan Stanley remains positive about Apple’s future prospects. They highlighted Apple’s upcoming developer conference in early June and the iPhone 16 launch in mid-September as events that could boost investor sentiment and enhance the bull case for the stock. The integration of compelling new AI features in the iPhone 16 could spur an upgrade cycle, historically a key driver of outperformance, and increase Product/Services spending per user as Apple solidifies its position in Edge AI.

Redburn Atlantic analysts downgraded Snowflake (NYSE: SNOW) and MongoDB (NASDAQ: MDB) from Neutral to Sell, expressing concerns that these companies lack a distinct advantage in Generative AI, which poses a risk of budget reallocation not currently reflected in their valuations.

According to Redburn, the true potential of generative AI lies in tailoring these technologies for enterprise applications beyond consumer-facing uses. While initial training costs may be covered by Big Tech firms, the customization process entails high expenses and complexity, necessitating extended integration periods that yield substantial long-term benefits.

In this evolving landscape, the emphasis has shifted from sheer data volume to the accessibility and quality of data. While enterprises seek to leverage existing data, the analysts noted that high-quality synthetic data embedded within certain models is often overlooked. They caution that not all enterprises will benefit equally from adopting Generative AI, with potential budget reallocation risks for players lacking direct exposure to this new technology stack. Companies positioned to deliver tangible benefits from Generative AI are viewed as better positioned for success.

UBS strategists view the recent downturn in AI-related tech stocks as a strategic investment opportunity, as outlined in a note released on Monday.

Despite a surge in early March driven by optimism surrounding AI’s commercial potential, tech stocks have since experienced a downturn. By March 15th, both the Philadelphia Semiconductor Index and the S&P 500 Semiconductor & Semiconductor Equipment Index had dropped over 6% within six sessions, reflecting revised investor expectations about the economy.

UBS, however, does not interpret this decline as a long-term concern. They believe that corrections in the stock prices of major AI beneficiaries could offer investors a chance to capitalize on the continued growth of AI companies, fueled by ongoing infrastructure development and transparent corporate investment intentions.

The strategists anticipate Generative AI to emerge as the dominant growth theme of the decade, with estimated annual revenue growth of around 70% for the AI industry until 2027. They predict robust earnings growth and higher equity prices in the coming years for the next generation of AI leaders.

UBS recommends diversifying tech portfolios beyond the established industry leaders, suggesting investments in emerging AI companies, including custom AI chip manufacturers, AI edge computing firms in Asia, and major semiconductor capital equipment providers. This diversification strategy aims to mitigate risks associated with market concentration and capitalize on the evolving landscape of AI technologies.