For purchasers interested in leveraging the early stages of the AI competition, semiconductor stocks have continued their upward trajectory. The advent of Conceptual AI made a substantial impact last year, propelling many top semiconductor innovators to experience heightened demand for their offerings as numerous companies embraced accelerated computing technologies.

In the aftermath of the recent 2024 GTC conference held by Nvidia (NASDAQ: NVDA), investors holding NVDA shares are contemplating whether the forthcoming generation of AI chips, Blackwell, will sustain exceptional sales growth.

Despite the remarkable advantages Blackwell presents, it’s crucial to acknowledge that NVDA stock has already undergone a substantial surge this year. Nvidia’s stock has nearly doubled on a year-over-year basis, currently up by approximately 97% as of the latest data, even though the first quarter has not yet concluded.

Some view Nvidia’s rapid ascent as a potential bubble, while others interpret it as a validation of AI’s significance. For those in the latter camp who perceive artificial intelligence as a transformative force in the industrial landscape rather than a mere overhyped trend, keeping an eye on the following companies in the device sector for AI applications could be rewarding.

Nvidia (NVDA)

Given Nvidia’s substantial lead in the realm of AI, attributed to CEO Jensen Huang’s forward-thinking vision, it’s uncertain whether another company of Nvidia’s caliber will emerge anytime soon. If you’re impressed by the company’s rapid progress, considering investing in NVDA stock during downturns might be prudent, rather than dismissing the AI sector as a speculative bubble and turning to less impressive competitors.

Although NVDA’s stock performance may resemble a typical bubble pattern, with gains of around 2,000% over the past five decades, a closer look at valuation metrics reveals that NVDA is not significantly more expensive than most other semiconductor stocks.

In fact, with a forward price-to-earnings ratio of 39, Nvidia appears relatively more affordable compared to many AI firms that are not experiencing comparable growth rates. As Nvidia continues to make sales and customers continue to stockpile its products, the so-called “peak” in Nvidia’s stock price may remain elusive for the foreseeable future.

Lam Research (LRCX)

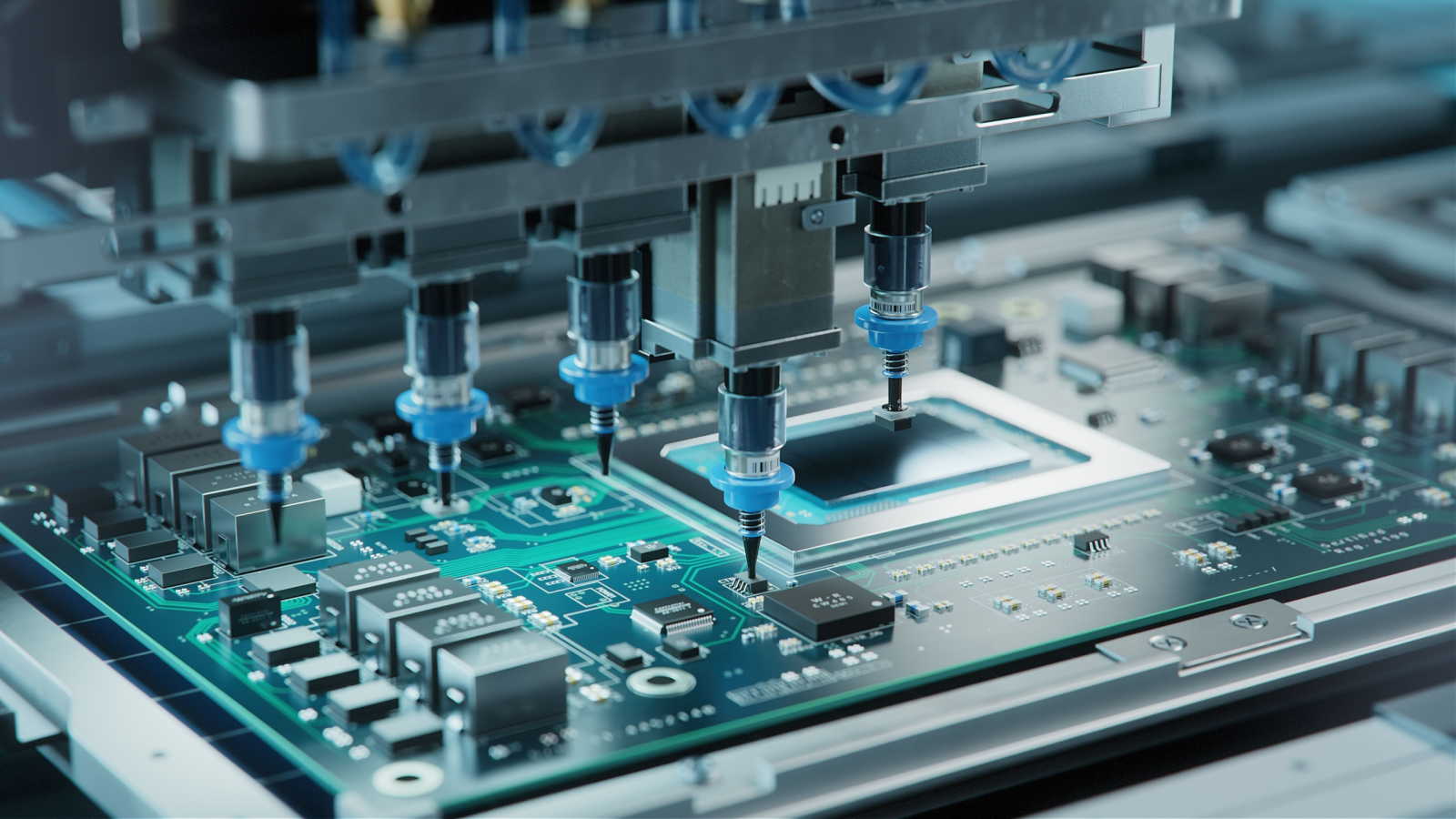

Lam Research (NASDAQ: LRCX) is another AI-centric stock that could potentially breach the $1,000 per-share mark in the near future. Similar to Nvidia, the company has been reaching new valuation highs recently, with assessment indicators suggesting a sustainable growth trajectory rather than a speculative bubble. Trading at approximately 26.6 times forward price-earnings, LRCX stock appears attractively priced, considering its role in supplying cutting-edge equipment to numerous major chip manufacturers.

Essentially, without Lam’s machinery, the semiconductor industry might struggle to meet the soaring demand for AI chips, memory units, and other essential hardware components required for AI model deployment. The increased demand for AI chips necessitates more manufacturing capacity and equipment, indicating that Lam’s growth potential could extend significantly, provided it maintains its current momentum for at least another year.

Over the past year, LRCX shares have nearly doubled, posting a remarkable 95% gain. While the wafer-fabrication equipment (WFE) sector is expected to remain robust amid the AI boom, it might be prudent to await a market correction before considering an investment in Lam Research.

Microsoft (MSFT)

Primarily recognized as a software and AI powerhouse in the enterprise domain, Microsoft (NASDAQ: MSFT) has been making significant strides in the technology sphere. Despite some setbacks in hardware ventures like the Windows Phone or HoloLens, Microsoft is striving to reduce its dependence on Nvidia’s dominant position in the AI chip market.

With its Cloud Maia 100 AI platform, Microsoft presents a viable alternative to Nvidia’s formidable H100 GPU. As the industry transitions from the H100 to the upcoming Blackwell B200 GPUs, Microsoft must sustain its technological advancements to remain competitive.

In the interim, Microsoft’s chip initiatives are unlikely to diminish its substantial procurement of Nvidia chips. To ensure the competitiveness of its data centers, the tech giant will continue to heavily invest in Nvidia’s Blackwell cards. However, if Microsoft achieves significant breakthroughs in chip technology over the next decade, it’s plausible that its reliance on Nvidia products may decrease.

As of the publication date, Joey Frenette held Microsoft stock. The opinions expressed in this article are solely those of the author, in accordance with the InvestorPlace.com Publishing Guidelines.

A seasoned investment analyst specializing in technology and consumer companies, Joey Frenette has a proven track record of identifying undervalued stocks with long-term growth potential in a fast-paced market. His insights have been featured in publications like Motley Fool Canada, TipRanks, and Barchart.