Artificial intelligence (AI) remains a prominent trend in the technology sector and a significant influencer of the stock market. Companies, regardless of their size, are actively developing new AI functionalities for both consumer and business applications. This strategic move allows them to monetize their offerings and expand their market presence. The AI market is showing robust growth with no signs of deceleration.

According to Bloomberg Intelligence, generative AI is projected to experience a substantial compound annual growth rate (CAGR) of 42% over the next decade, potentially evolving into a $1.3 trillion industry globally. The transformative potential of AI extends to various aspects of society, impacting how we work, communicate, and engage with entertainment content.

Given the high stakes involved, it is unsurprising that established corporations and startups alike are vigorously competing to lead the AI race. Here are three AI stocks that have the potential to turn a \(10,000 investment into \)1 million by February 2024.

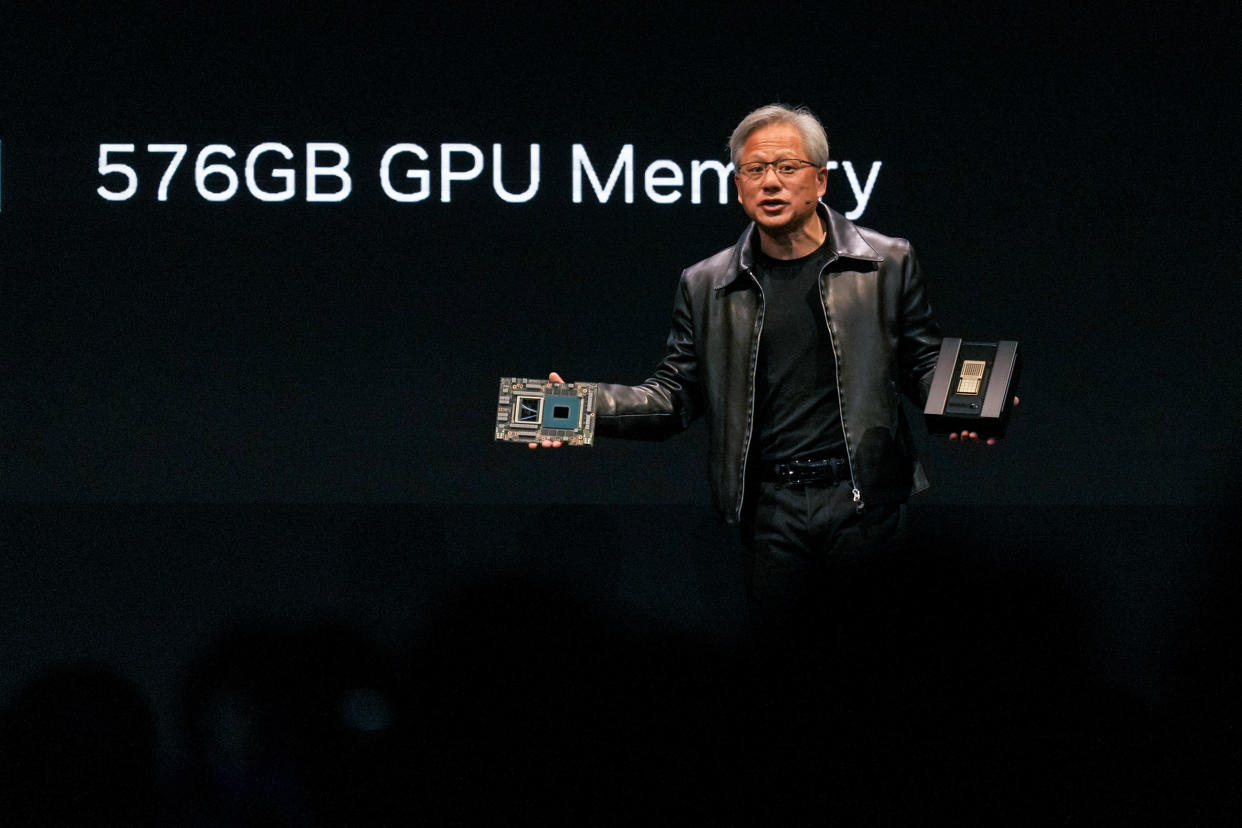

Nvidia (NVDA)

Renowned AI chip manufacturer Nvidia (NASDAQ: NVDA) is set to announce its latest earnings on February 21, with expectations soaring. Analysts anticipate an earnings per share (EPS) of $4.59, reflecting a remarkable over 700% surge from the corresponding quarter of the previous year. The upcoming earnings report is being closely watched by market participants, with some referring to it as a pivotal moment for the stock market. Deutsche Bank highlighted the significance of Nvidia’s earnings in a client note, emphasizing its potential impact on market sentiment.

In terms of stock performance, NVDA has already surged by 50% this year, leading to a 252% increase over the past 12 months. Options trading data suggests that Nvidia’s shares could potentially climb by an additional 11% or more following the latest quarterly results, as indicated by insights from options analytics service ORATS. With a market capitalization of $1.8 trillion, Nvidia has surpassed tech giants such as Amazon (NASDAQ: AMZN) and Google’s parent company, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Symbotic (SYM)

Moving on to a lesser-known player, Symbotic (NASDAQ: SYM) operates in the realm of AI despite not being a microchip or semiconductor producer. This Massachusetts-based company specializes in robotics warehouse automation, leveraging proprietary AI technology in its operations. While SYM stock has experienced a pullback since the beginning of this year, this follows a remarkable surge in 2023. Over the past 12 months, the stock has climbed by 155%, with a 312% increase since its initial public offering in 2022.

Recently, Symbotic reported earnings that exceeded its own projections, with \(14 million in adjusted EBITDA on \)368 million in revenue. The company’s sales witnessed a 79% year-over-year uptick. Notably, Symbotic achieved adjusted profitability for the second consecutive quarter, signaling a positive trajectory for its future performance. If Symbotic sustains its robust sales and profit figures, it is likely to witness another upswing in its stock value.

Alphabet (GOOG) (GOOGL)

Leading the global AI race is Alphabet. The company remains deeply committed to AI, recently rebranding its primary AI chatbot as “Gemini,” replacing its former moniker, “Bard.” This strategic move aligns the chatbot’s name with Alphabet’s large-language learning models utilized for AI training. The initial unveiling of the name Bard coincided with the beta launch of Alphabet’s first AI chatbot in March 2023.

In conjunction with the rebranding, Alphabet introduced a new mobile version of its chatbot and a premium subscription tier named “Gemini Advanced.” Alphabet is at the forefront of monetizing its AI solutions, aiming to develop an advanced AI assistant for both individual consumers and businesses. Priced at $19.99 per month, Gemini Advanced includes two terabytes of cloud storage shareable among family members.

Alphabet has seamlessly integrated its AI capabilities across its suite of office tools, including Gmail, Docs, Slides, Sheets, and Meet. Over the past year, GOOGL stock has surged by 53%. An investment of \(10,000 in Alphabet’s stock during its 2004 initial public offering (IPO) would now be valued at over \)300,000.

Joel Baglole holds long positions in NVDA and GOOGL. The opinions expressed in this article are solely those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Joel Baglole, a seasoned business journalist with 20 years of experience, has contributed to reputable publications such as The Wall Street Journal, The Washington Post, and Toronto Star, as well as financial platforms like The Motley Fool and Investopedia.